For any business leader in Texas, understanding the role of insurance in a natural disaster strategy is no longer optional—it's a critical component of operational survival. Effective insurance coverage is a strategic asset that protects financial stability and ensures a business can recover from the increasingly severe weather events impacting the state.

The Rising Tide of Weather Risks for Texas Businesses

The financial impact of natural disasters in Texas is escalating. From hurricanes impacting the petrochemical hubs on the Gulf Coast to winter storms capable of disabling statewide infrastructure, the risks are tangible. For industries like Energy, Agriculture, and Construction, these events represent direct threats to operational continuity and financial performance.

This new environment requires a strategic approach. Business leaders must view insurance not as a compliance item, but as a core element of a comprehensive resilience strategy. Inadequate preparation can lead to severe financial losses, supply chain disruption, and prolonged operational downtime.

The New Financial Reality of Extreme Weather

The increasing cost of extreme weather events signals a growing risk landscape. Globally, the financial impact has become significant. In the first half of a recent year, for example, insured losses from natural catastrophes reached approximately $80 billion, nearly double the 10-year average. This marked the fifth consecutive year that first-half losses exceeded $50 billion, indicating a consistent and costly trend.

This directly affects Texas companies through higher premiums, more stringent underwriting criteria, and a more complex insurance market. Understanding these dynamics is the first step toward building a risk management framework that can withstand future challenges.

Why Traditional Risk Models Are Falling Short

Relying on historical weather data to predict future risk is no longer sufficient. Traditional models used for risk assessment are struggling to keep pace with rapid climate shifts. This creates a dangerous gap between perceived risk and actual vulnerability.

When you rely on outdated climate data, you're leaving your business dangerously exposed. A "100-year flood" plain might now be a "20-year flood" plain, but if your risk strategy hasn't caught up, your operations are still wide open to major disruption.

Key Texas industries face unique and evolving threats that demand a forward-looking approach:

- Energy & Petrochemical: Stronger hurricanes pose a direct threat to coastal infrastructure, leading to shutdowns and complex, expensive repairs.

- Logistics & Manufacturing: Flash floods and ice storms can paralyze transportation networks, creating immediate and costly supply chain chaos.

- Agriculture: Prolonged droughts and sudden, severe freezes can destroy crop yields and impact livestock, jeopardizing an entire season's revenue.

- Construction: Extreme heat and severe storms cause project delays, damage materials, and create significant safety risks for workers.

Proactive planning is essential. To understand the specific threats from hurricanes—a major peril for the state—review our detailed guide on hurricane preparedness for businesses. This is a valuable starting point for building a targeted resilience plan.

Decoding Your Commercial Insurance Policy

Analyzing a commercial insurance policy can be complex. For business leaders in Texas, understanding core concepts is critical to ensuring your organization can recover from a natural disaster.

Instead of focusing on legal jargon, let's examine the key terms. A policy is a financial recovery blueprint. Every clause, exclusion, and definition influences how, or if, your business can resume operations after a major weather event. An informed discussion with your broker begins with knowing what these terms mean for your bottom line.

Named Perils Versus All-Risk Policies

The structure of your policy is based on one of two approaches: "Named Perils" or "All-Risk." The distinction is significant for a Texas business facing a range of hazards from hurricanes to hailstorms.

A Named Perils policy explicitly lists the specific events it covers, such as fire, wind, or hail. If a disaster is not on that list, it is not covered.

An All-Risk (or "Open Perils") policy functions differently. It covers damage from any cause except for those specifically listed as exclusions. This typically provides broader protection, but it requires careful review of the exclusions list, which often contains critical gaps like flood damage.

For a Texas manufacturer, a named perils policy might cover tornado damage but exclude a subsequent flash flood. An all-risk policy would likely cover both, provided flooding was not a specific exclusion.

Actual Cash Value Versus Replacement Cost

When a claim is filed, the valuation method is one of the most important financial details in the policy. It determines the amount you will receive to rebuild.

Actual Cash Value (ACV) pays for the value of your property at the moment before it was damaged. It is the replacement cost minus depreciation.

Replacement Cost (RC) covers the full amount to repair or replace your damaged property with new materials of similar quality, without a deduction for depreciation. This is what most businesses require to fully restore operations without a significant cash shortfall.

Imagine a construction company's five-year-old heavy machinery is destroyed. An ACV policy might value it at $200,000. However, purchasing a new, equivalent model could cost $350,000. Replacement Cost coverage bridges that $150,000 gap—a difference that could determine the speed of recovery.

Unpacking Deductibles and Exclusions

A deductible is the amount you pay out-of-pocket before insurance payments begin. For natural disasters, these are often not a flat fee.

Frequently, they are a percentage—typically 2% to 5%—of the property's total insured value. For a petrochemical facility valued at $50 million, a 5% hurricane deductible means the company is responsible for the first $2.5 million in damages.

Exclusions are equally critical. Standard commercial property policies almost universally exclude flood damage from rising water. For any Texas business near the coast or in a flood plain, this is a significant gap that must be addressed with a separate flood insurance policy.

Finally, consider add-ons like Business Interruption (BI) coverage. This covers lost income and ongoing operating expenses (such as payroll) if a covered disaster causes a shutdown. For Texas logistics and manufacturing firms with lean supply chains, BI coverage is a vital tool for mitigating the domino effect of downtime.

Disclaimer: ClimateRiskNow does not sell insurance or provide financial advice. The information presented in this article is for educational and informational purposes only and should not be construed as a recommendation for any specific insurance product or provider. We strongly encourage you to consult with a qualified insurance professional to assess your specific needs and risks.

Mapping the Most Critical Threats to Texas Industries

Understanding insurance policy language is the first step. Applying it effectively requires connecting those terms to the specific threats facing Texas businesses. A generic policy often fails to account for the unique mix of risks inherent in the state's geography and economy.

Each peril, from a coastal hurricane to a sudden winter storm, creates different operational shockwaves.

For any Texas business, a localized risk assessment is a strategic imperative. The damage from a hurricane to a Gulf Coast petrochemical plant differs greatly from how a flash flood disrupts a Dallas-Fort Worth logistics hub. The only way to build a robust risk management plan—and by extension, secure appropriate insurance coverage—is to map these specific threats directly to your operational vulnerabilities.

Sector-Specific Impacts from Texas Perils

The operational structure of Texas's key industries makes them particularly vulnerable to certain disasters. A winter storm might be an inconvenience for some, but for an interconnected energy grid, it can trigger a systemic failure.

Let's break down how these threats impact core sectors:

- Hurricanes and Tropical Storms: For the Energy & Petrochemical sector on the Gulf Coast, hurricanes represent an existential threat. Risks include physical damage to refineries from wind and storm surge, prolonged shutdowns due to evacuation orders, and major disruptions to shipping lanes.

- Flooding: Manufacturing and Logistics are severely impacted by flooding. A single flash flood can damage inventory, destroy expensive machinery, and close major transportation arteries like I-10 or I-35, severing supply chains for days or weeks.

- Tornadoes and Severe Hail: The Construction industry can suffer catastrophic losses in minutes. Tornadoes and large hail can demolish projects, damage heavy equipment, and destroy material stockpiles. For Agriculture, a hailstorm can obliterate an entire season's worth of high-value crops.

- Wildfires and Drought: Prolonged drought strains water resources essential for both Agriculture and many Manufacturing processes. Subsequent wildfires threaten not just rural land but also expanding commercial developments at the urban-wildland interface.

- Winter Storms and Freezes: Winter Storm Uri demonstrated the systemic impact of a deep freeze. It can trigger widespread power outages, halting industrial activity. It freezes pipelines, bursts fire suppression systems in warehouses, and makes transportation impossible.

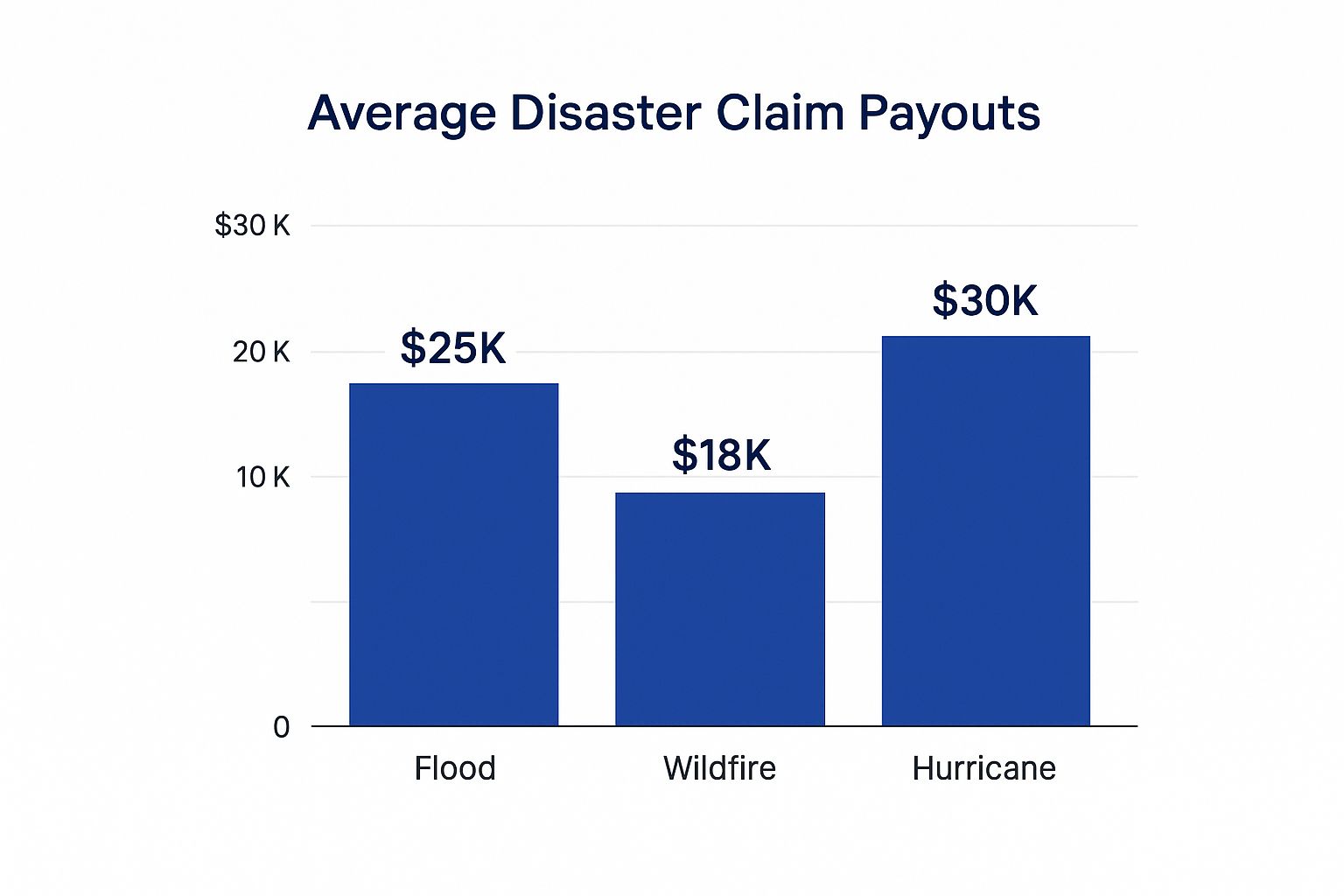

This chart provides a summary of average claim payouts for common disasters, illustrating the potential financial exposure.

As shown, hurricanes consistently result in the highest average claims, underscoring the immense financial risk for businesses operating near the coast.

To better visualize these intersecting risks, this matrix breaks down how each major Texas peril directly threatens the state's foundational industries.

Natural Disaster Impact Matrix for Key Texas Industries

This table summarizes the primary operational risks that specific natural disasters pose to Texas's core economic sectors. It's designed to help businesses quickly identify and prioritize their biggest vulnerabilities.

| Texas Peril | Energy & Petrochemical Impact | Manufacturing & Logistics Impact | Agriculture Impact | Construction Impact |

|---|---|---|---|---|

| Hurricanes | Catastrophic facility damage, prolonged shutdowns, supply chain disruption | Port closures, impassable transportation routes, inventory loss from water damage | Crop destruction, livestock loss, damage to farm infrastructure | Project delays, site flooding, destruction of materials and equipment |

| Flooding | Site access restrictions, equipment damage, operational shutdowns | Submerged inventory, damaged machinery, severed transportation links (road/rail) | Widespread crop loss, soil erosion, contaminated water sources | Worksite damage, foundation instability, project material loss |

| Tornadoes/Hail | Damage to exposed infrastructure (tanks, pipelines), power loss | Warehouse roof/structural damage, destruction of vehicle fleets and inventory | Total crop destruction in minutes, damage to buildings and equipment | Destruction of projects mid-build, damage to heavy equipment |

| Wildfires/Drought | Threat to facilities at urban-wildland interface, water supply issues for cooling | Water shortages for production processes, supply chain disruptions in affected areas | Devastating crop failure, livestock water/feed shortages, loss of grazing land | Project site threats, work delays due to air quality, water restrictions |

| Winter Storms | Frozen pipelines, power grid failure, instrumentation failure, refinery shutdowns | Production halts due to power loss, frozen fire suppression systems, shipping paralysis | Livestock loss due to cold, damage to irrigation systems, crop freeze-out | Project shutdowns, burst pipes on-site, hazardous work conditions |

Understanding these direct impacts is the first step. Businesses must see these perils not as isolated events but as interconnected threats requiring a comprehensive, industry-specific defense strategy.

The Evolving Nature of Natural Disaster Risk

Relying solely on historical data for risk assessment is an increasingly outdated practice as weather patterns shift. Climate change is altering the frequency, intensity, and location of certain disasters, demanding a more forward-looking approach to risk management.

A notable example is the Los Angeles County wildfires, which caused approximately $40 billion in insured damages. These fires occurred during what was historically California's wet winter season, signaling that the fire threat has become a year-round problem, defying previous assumptions.

For Texas businesses, the takeaway is clear: yesterday's flood map or wildfire risk zone might be useless today. You have to get proactive, folding forward-looking climate projections into your planning. Otherwise, you risk getting blindsided by a threat you never saw coming.

A tailored analysis goes beyond naming perils; it investigates the secondary and tertiary effects on specific operations. Mapping these vulnerabilities is the foundation of any effective plan. You can explore building a stronger framework with our guide on effective business risk management strategies.

This process—connecting specific threats to real-world operational impacts—grounds your conversations with insurance professionals. It ensures you are discussing what is truly at stake, backed by a realistic, data-driven view of your company’s exposure.

How to Conduct a Modern Risk Assessment

A modern risk assessment for a Texas business must be a dynamic, forward-looking process that evaluates unique vulnerabilities to increasingly unpredictable weather. Relying on historical weather data alone misses the new realities of climate volatility.

The goal is to move beyond a static checklist to a living blueprint that identifies weak links before a disaster does. This requires examining everything from the structural integrity of buildings to hidden dependencies in the supply chain. A proper assessment provides the hard data needed for a substantive conversation about your insurance natural disaster coverage and resilience investments.

Moving Beyond Historical Data

For decades, risk was measured against past events. With today's weather extremes, that approach is becoming obsolete. A modern assessment must shift from reactive to proactive by incorporating forward-looking climate projections.

This requires asking more specific, strategic questions:

- How will rising sea levels affect our coastal energy terminals over the next 10-20 years?

- What is the actual probability of another "100-year" flood impacting our logistics hub?

- How will more frequent and intense droughts affect the water supply for our manufacturing operations?

Incorporating these future-focused data points provides a more realistic picture of long-term corporate risk.

A critical mistake is assuming that just because a location has never flooded, it’s safe. After Hurricane Harvey, areas once considered low-risk went underwater. That was a brutal lesson that historical flood plains are no longer a reliable guide.

Key Pillars of a Comprehensive Assessment

A robust risk assessment is built on several core pillars. Each provides a different lens for identifying vulnerabilities across the entire operation, forming the foundation of a real-world business continuity strategy.

Asset Valuation and Physical Vulnerability: Determine the real-world cost and timeline to replace critical machinery. Assess the physical weaknesses of your structures against specific Texas perils—such as the wind-load capacity of walls during a hurricane or the roof's resistance to a major hailstorm.

Supply Chain Interdependency Mapping: Your risk extends beyond your property line. It is crucial to map your entire supply chain, identifying key suppliers, transportation routes, and logistics partners. A winter storm that closes I-35 can be as damaging as a fire in your warehouse if it halts production.

Operational and Workforce Disruption Analysis: Consider non-physical impacts. What happens to workforce availability when a mandatory evacuation is issued? What is the plan for remote work if a power grid failure, like the one during Winter Storm Uri, persists for days?

Regulatory and Compliance Impact Review: Texas has specific regulations that apply during a disaster, such as environmental compliance rules for petrochemical plants during a flood. Your assessment must account for these local regulatory risks and the potential for penalties if protocols fail.

This detailed evaluation provides the raw data needed to build a resilient organization. The findings are the first step in crafting an effective strategy, as detailed in our guide on how to create a disaster recovery plan. A modern assessment delivers the clarity needed to make informed decisions, ensuring your business is prepared for the challenges of tomorrow.

Tipping the Scales with Advanced Weather Intelligence

For any Texas business, reacting to disasters as they occur is an ineffective strategy. Gaining a competitive advantage requires anticipating threats before they materialize. Advanced weather intelligence provides this decisive edge.

This is not a standard weather forecast. Sophisticated platforms combine predictive modeling, machine learning, and hyper-local data to quantify specific risk exposure. These tools are becoming essential for building genuine operational resilience.

This technology allows a shift from a defensive posture to a proactive strategy. Instead of bracing for impact, you can anticipate it, model its potential effects across your operations, and make strategic decisions backed by data.

Quantifying Threats Before They Strike

Advanced weather intelligence platforms deliver asset-level risk analysis, moving beyond vague regional warnings. In practice, this means knowing the specific probability of a catastrophic flood at your Houston warehouse or the projected wind speeds your West Texas construction site will face from an approaching storm.

This level of detail changes the decision-making process. You can quantify potential financial losses, identify the weakest links in your supply chain, and pinpoint which physical assets require immediate reinforcement. It provides a data-driven answer to the question: "What is our real exposure?"

The scale of these events makes this preparation essential. In the first half of a recent year, total economic losses from natural disasters worldwide reached $162 billion. The United States accounted for $126 billion of that damage—the highest on record for a first-half period. You can read more about the growing global insurance gap on weforum.org.

Optimizing Mitigation and Insurance Strategies

With a precise understanding of your risk profile, you can allocate resources more intelligently. Instead of making uniform upgrades, you can direct capital to the specific areas where it will have the greatest impact.

This data-backed approach fundamentally changes your conversations with insurance partners. You are no longer just a passive buyer of a policy; you are an informed stakeholder who can demonstrate a deep, analytical understanding of your own risk and the proactive steps you've taken to reduce it.

This analytical clarity creates several strategic advantages:

- Targeted Investments: A logistics company might use flood modeling to decide which distribution centers require equipment elevation, avoiding unnecessary spending at lower-risk sites.

- Strengthened Continuity Plans: An energy firm can simulate a hurricane's impact on coastal infrastructure, refining evacuation and shutdown procedures to minimize downtime. To see how this works, you can review our disaster recovery planning template.

- Informed Negotiations: When you can present underwriters with detailed risk assessments and documented mitigation efforts, you enter negotiations from a position of strength, armed with the same kind of data they use.

Ultimately, weather intelligence provides the foresight needed to build a multi-layered defense. It helps ensure your operational resilience and your insurance natural disaster coverage are aligned not with old assumptions, but with the specific, forward-looking threats your Texas business will actually face.

Don't Just Insure—Fortify

While a solid natural disaster insurance policy is essential, it is a reactive financial tool used after damage has occurred. True operational resilience for a Texas business is built long before storm warnings are issued.

This requires a defense-in-depth system of proactive, physical, and strategic upgrades that lower fundamental risk. These actions are an investment in business continuity. By hardening assets and diversifying dependencies, you reduce a disaster's impact, accelerate recovery, and protect your market position.

Real-World Mitigation for Texas Industries

Effective mitigation must be tailored to the specific threats your Texas operation faces. This means practical, robust upgrades that address the state’s primary dangers—hurricanes, floods, hail, and extreme temperatures.

Here is what that looks like for different sectors:

Energy & Petrochemical: Along the Gulf Coast, this means elevating critical control systems and substations above projected flood levels, reinforcing storage tanks to handle higher wind loads, and installing flood barrier systems. These are defenses against catastrophic failure.

Manufacturing & Logistics: A key vulnerability is the supply chain. Actively build relationships with secondary suppliers in different geographic regions to prevent a single disaster from halting production. On-site, elevating finished goods and key machinery is a powerful defense against flooding.

Agriculture: High-tunnel greenhouses can protect high-value crops from large hail and extreme winds. For ranchers, a drought management plan is non-negotiable, including identifying alternative water sources and stockpiling feed.

Construction: Disciplined worksite protocols, such as securing materials and equipment before a major storm, can save millions. Using wind-resistant building materials and designs protects the current job and adds long-term value to the finished project.

It's crucial to remember your resilience plan can't stop at your own property line. Your plant might be perfectly protected from floodwaters, but if the only road in and out is underwater for a week, you're still out of business.

This forward-thinking approach—strengthening your operational core before a disaster—is the highest form of risk management. It ensures that when a storm hits, your business is positioned not just to survive, but to recover faster and more effectively than the competition.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided in this article is for educational purposes only and should not be interpreted as financial advice or a recommendation for any specific insurance provider or product. We strongly encourage business leaders to consult with qualified insurance and risk management professionals to assess their unique operational risks.

Frequently Asked Questions

Here are common questions from Texas business leaders regarding natural disaster insurance and operational risk. The answers reinforce key concepts covered in this guide to support strategic decision-making.

How Does Business Interruption Insurance Work After a Natural Disaster?

Business Interruption (BI) insurance is designed to cover lost income and ongoing operating expenses if a disaster forces a temporary shutdown. The coverage is typically triggered by direct physical damage to your insured property.

For example, if a hurricane damages a Houston manufacturing plant, BI helps replace lost profits and covers fixed costs like payroll during the rebuilding process. The details are important, particularly the policy’s "period of restoration," which defines the duration of benefits. It is also important to verify if the policy covers shutdowns caused by mandatory evacuations or widespread power outages, which can halt operations even without direct physical damage.

Why Is Flood Damage Excluded from Standard Business Policies?

This is a critical distinction. Standard commercial property policies almost never cover damage from flooding, which is specifically defined as damage from rising or overflowing bodies of water.

The reason is risk management. A major flood can cause catastrophic, concentrated losses across an entire region, making it financially unviable for a standard insurance package.

To obtain coverage, businesses in high-risk areas like the Texas Gulf Coast or inland floodplains must purchase a separate flood insurance policy, available through the National Flood Insurance Program (NFIP) or private insurers. Understanding this gap is the first step toward ensuring comprehensive protection.

What Can We Do to Potentially Lower Our Insurance Costs?

While ClimateRiskNow does not provide financial advice, industry best practice shows that insurers often view businesses that take risk management seriously more favorably. Proactively mitigating risks signals that you are a more resilient, lower-risk partner.

Investing in targeted mitigation efforts shows that you are a lower-risk partner. Documenting these actions provides tangible proof of your commitment to operational resilience, which is a key consideration for underwriters assessing your overall risk profile.

Actions that can demonstrate proactive risk management include:

- Structural Reinforcements: Exceeding minimum building codes for hurricane resistance.

- Equipment Elevation: Raising critical machinery and electrical systems above expected flood levels.

- Documented Planning: Creating, maintaining, and regularly testing a robust business continuity and disaster recovery plan. For a valuable starting point, explore our guide on how to prepare for hurricanes and other major weather events.

ClimateRiskNow delivers the forward-looking, actionable weather risk intelligence that Texas businesses need to shift from a reactive stance to a proactive resilience strategy. Our Sentinel Shield platform quantifies your specific operational exposure to hurricanes, floods, freezes, and more, empowering you to protect your assets and guarantee continuity.