Insurance for natural disaster is not just a policy; it's a critical component of a company's financial resilience, designed to facilitate recovery after a catastrophic event like a hurricane, flood, or winter storm. For any business operating in Texas, where extreme weather is a recurring operational threat, understanding this coverage is essential for long-term viability.

Why Natural Disaster Insurance Is a Core Business Strategy

For leaders of Texas-based businesses, severe weather is not a hypothetical risk but a recurring threat that must be integrated into operational and financial planning.

Hurricane Harvey, with estimated damages of $125 billion, serves as a powerful case study on the financial devastation these events can cause. Addressing insurance requirements before a storm forms is a foundational element of a robust business continuity plan.

This guide provides actionable insights for executives in Texas industries—including Energy, Manufacturing, Logistics, Agriculture, and Construction—to make informed decisions. The objective is to view insurance not as a sunk cost, but as a strategic tool for managing catastrophic financial risk.

Disclaimer: The information provided here is for educational purposes only and does not constitute financial advice. ClimateRiskNow does not sell insurance or financial products. We recommend consulting with qualified risk management and insurance professionals to address your specific business needs.

Thinking Beyond the Policy

Viewing insurance solely as a post-disaster payout misses its strategic value. A well-structured insurance program, developed with expert guidance, is an instrument for strengthening an entire operation.

The underwriting process itself, including risk assessments, can identify previously unknown operational vulnerabilities. For example, analyzing insurance requirements might highlight a critical need to upgrade a facility's storm readiness or diversify the supply chain to mitigate single-source dependencies.

This proactive approach is vital. The lessons learned from Hurricane Harvey demonstrated that businesses unprepared for the financial and operational fallout faced crippling downtime and massive uninsured losses.

When insurance is integrated into core risk management, it empowers a business to:

- Quantify financial exposure from events like floods and high winds.

- Ensure operational continuity by securing liquidity for immediate repairs and recovery.

- Protect the balance sheet from the financial shock of a catastrophic event.

- Signal operational resilience and stability to investors, lenders, and customers.

Ultimately, proactively managing insurance needs allows a shift from a defensive posture to a strategic one, transforming a necessary expense into a pillar of corporate resilience.

Insurance is a critical piece of the puzzle, but it's just one piece. For a Texas business to be truly prepared, that policy needs to be part of a much broader strategy for resilience. It works alongside your operational plans, physical preparations, and financial foresight.

Here’s how these four pillars work together to create a comprehensive defense against extreme weather events.

The Four Pillars of Business Resilience in Texas

| Pillar | What It Means for Your Business | Example for a Texas Logistics Company |

|---|---|---|

| Operational Preparedness | Developing and testing plans to maintain core functions during and after a disaster. | Rerouting drivers away from projected hurricane paths and having backup communication systems ready. |

| Physical Mitigation | Investing in structural and non-structural measures to reduce physical damage to assets. | Reinforcing warehouse doors to withstand high winds and elevating critical equipment above flood levels. |

| Financial Readiness | Securing the capital needed for recovery, including insurance, cash reserves, and lines of credit. | Securing a comprehensive flood insurance policy and maintaining a dedicated emergency fund for deductibles. |

| Risk Transfer (Insurance) | Shifting the financial burden of catastrophic losses to an insurer through a formal policy. | The insurance policy pays for roof repairs and spoiled inventory after a hurricane, preventing a major capital drain. |

As the table shows, insurance doesn't replace the need for a good plan or a sturdy building—it complements them. When all four pillars are strong, your business is in the best possible position to withstand the storm and recover quickly.

Understanding the Shifting Landscape of Catastrophe Risk

The financial impact of natural disasters is intensifying, and for Texas-based businesses, this escalating risk demands executive attention. Decision-makers in sectors like energy, manufacturing, and logistics can no longer rely on historical storm data to predict future financial exposure. The nature of catastrophic risk is evolving, driven by powerful, interconnected forces.

This is a measurable trend. Globally, insured losses from natural catastrophes have been increasing by 5-7% annually. In a recent year, insured losses reached $137 billion, while total economic damages were a staggering $318 billion.

This resulted in a massive $181 billion protection gap—uninsured losses that businesses and communities had to absorb directly. The full research on catastrophe trends provides a detailed analysis of this growing problem.

This upward trend is primarily driven by two compounding factors.

The Compounding Risk Factors

First, there is an increasing concentration of assets in high-risk areas. As Texas's economy expands, so does the value of its infrastructure—more high-value industrial plants, sprawling distribution centers, and major construction projects. Much of this development occurs in locations historically vulnerable to hurricanes and floods, particularly along the Gulf Coast.

Simultaneously, we are observing an increasing intensity and frequency of severe weather events. Storms are producing higher rainfall totals, heatwaves are becoming more extreme, and deep freezes are impacting regions of the state unaccustomed to such conditions. Our guide on the connection between climate change and natural disasters explores this topic in more detail.

When more valuable assets are placed in the path of more powerful storms, the potential for financial loss grows exponentially. This is the core of compounding risk, and it makes past performance an unreliable predictor of future outcomes.

Why Forward-Looking Assessments Are Crucial

This new reality necessitates forward-looking risk assessments. For a manufacturing plant or petrochemical facility in Texas, reviewing damage from a decade-old storm is insufficient. The critical question is what that same event would do to a larger, more valuable operation today.

Executives should be asking:

- How has the value of our physical assets—buildings, equipment, and inventory—grown at this location over the past decade?

- If a more intense storm forces a longer shutdown, what would our business interruption losses look like now?

- Are our key suppliers also located in high-risk zones, creating hidden vulnerabilities in our supply chain?

Answering these questions requires data-driven analysis, not guesswork. A clear understanding of current and future financial exposure enables a more productive dialogue about risk management strategies and the specific role that insurance for natural disaster should play in your company's resilience plan.

Navigating the Key Types of Commercial Disaster Coverage

To engage in a productive dialogue with brokers or risk managers, decision-makers must understand the available tools. A comprehensive insurance program functions like a specialized toolkit for financial recovery, where each policy is designed for a specific purpose. Understanding these instruments is key to building a robust program to protect Texas operations.

A standard Commercial Property policy is the foundation, but it often has significant exclusions related to extreme weather. This is where specialized coverages become essential.

The Foundation: Commercial Property Insurance

Most businesses begin with a standard Commercial Property insurance policy. This covers physical damage to buildings, equipment, and inventory from common perils like fire or theft.

However, a critical exclusion in most standard policies is damage from major natural disasters, such as floods, earthquakes, and, particularly in coastal Texas, windstorms.

The assumption that a primary property policy will cover damage from a hurricane's storm surge is a common and dangerous misconception. For any Texas business, relying solely on this policy is a significant financial risk.

Essential Add-Ons for Real Disaster Protection

To address these coverage gaps, businesses must add specific endorsements or purchase separate policies. These are the specialized tools needed to manage the unique risks of operating in a state prone to severe weather.

Key coverages to consider include:

- Flood Insurance: Typically a separate policy, often sourced through the National Flood Insurance Program (NFIP) or the private market. It is designed to cover losses directly caused by flooding. For businesses near the coast, a river, or a designated flood zone, this coverage is critical.

- Windstorm and Hail Coverage: In designated coastal counties in Texas, damage from named storms or high winds is often excluded from standard property policies. A separate windstorm policy is necessary to cover damage to roofs, windows, and building structures.

- Business Interruption (BI) Insurance: This provides a financial lifeline when a disaster forces an operational shutdown. It is designed to replace lost income and cover ongoing expenses like payroll, rent, and loan payments during the restoration period. BI coverage is typically triggered only by direct physical damage covered under a corresponding property or disaster policy.

Understanding how these policies interact is crucial. For instance, a flood might destroy critical machinery, but without the appropriate coverage for that equipment, the loss may not be recoverable. Our guide on understanding equipment breakdown insurance delves deeper into protecting these vital assets.

A critical takeaway for Texas executives: a disaster recovery plan is incomplete without knowing precisely what triggers each insurance policy. Discovering a coverage gap after an event is a devastating and preventable error.

This table illustrates how these coverages fit together.

Comparing Commercial Coverages for Disaster Events

| Coverage Type | What It Primarily Protects | Common Scenarios Covered |

|---|---|---|

| Commercial Property | Buildings, equipment, inventory, and physical assets on-site. | Fire, theft, vandalism, and non-excluded weather events (e.g., a burst pipe). |

| Flood Insurance | Physical damage to property and contents caused by flooding. | Storm surge from a hurricane, overflowing rivers, or heavy rainfall accumulation. |

| Windstorm/Hail | Structural damage caused specifically by high winds or hail. | Roof damage from a hurricane, broken windows, or siding torn off by a tornado. |

| Business Interruption | Lost income and ongoing operating expenses after a covered event. | Paying rent and payroll while your flooded storefront is being repaired. |

| Equipment Breakdown | Repair or replacement of essential machinery after a covered failure. | An electrical surge from a lightning strike frying your production line controls. |

As shown, each policy serves a distinct function. Layering them correctly creates a resilient financial safety net.

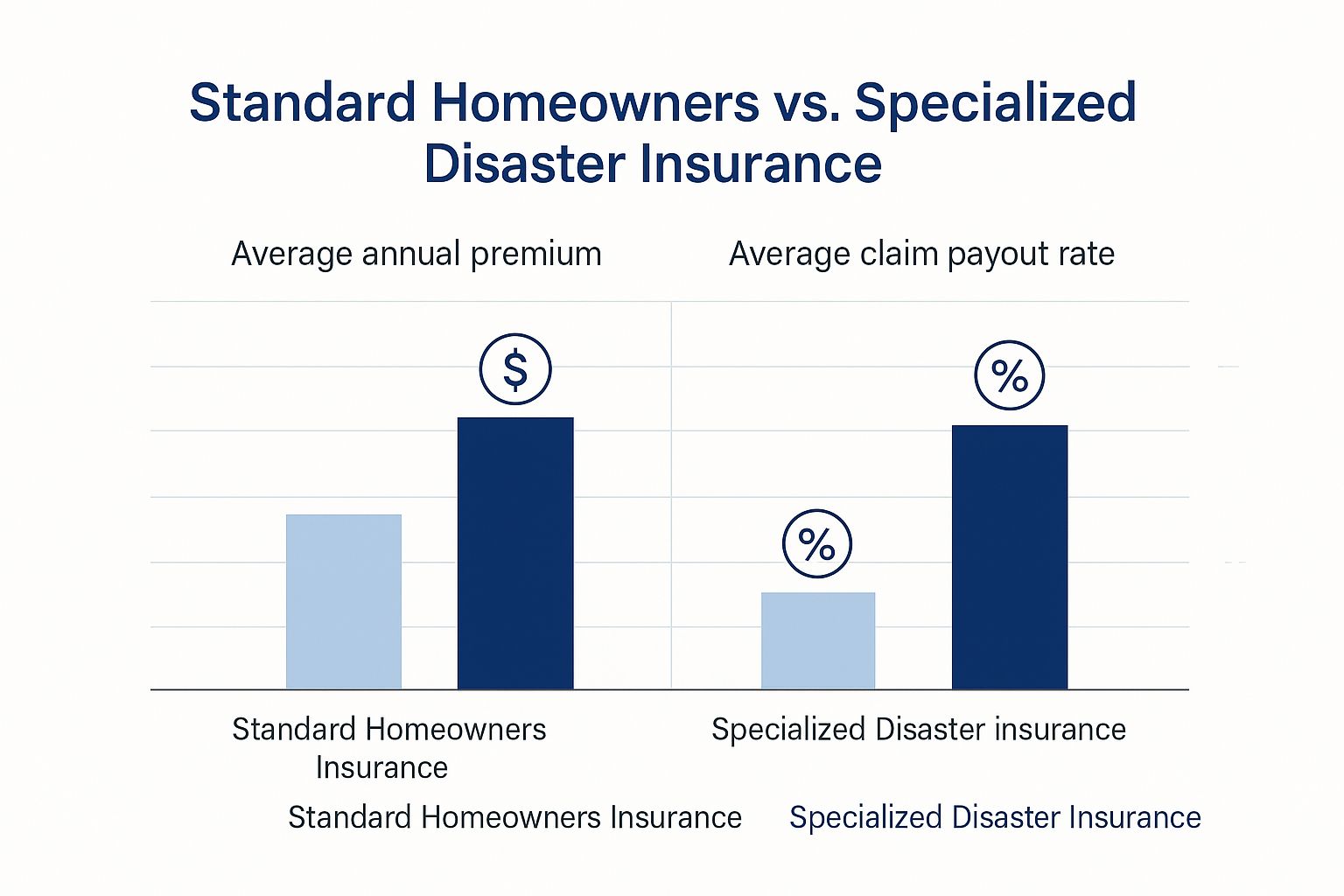

This image really drives home the difference between standard policies and the specialized disaster coverage you need.

The data tells a clear story. While specialized disaster insurance costs more upfront, its claim payout rate is much higher because it’s specifically designed for these expensive, catastrophic events. Putting together the right mix of these coverages isn’t just an expense—it’s a core strategy for financial survival.

What Really Drives Your Insurance Costs and Availability

The pricing of natural disaster insurance is the result of a deliberate, data-driven risk assessment. For business leaders in Texas, understanding these factors is crucial for budgeting, strategic planning, and risk mitigation.

Ultimately, an insurance premium represents a company's quantified exposure to a catastrophic event. Insurers use sophisticated methods to model future risk, and this directly impacts pricing.

Geographic and Industry-Specific Risk Factors

The single largest driver is physical location. A manufacturing plant on the Gulf Coast faces a different hurricane risk profile than one in North Texas, and premiums reflect that reality. Underwriters use detailed geospatial data that overlays storm surge zones, floodplains, and historical tornado paths onto asset locations.

The nature of the business is equally important. A logistics company with a large vehicle fleet has a different hail risk than a petrochemical facility, where the primary concern might be business interruption from a deep freeze. The higher an operation's susceptibility to specific weather events, the higher the insurer's risk rating.

The core principle is that higher quantifiable risk translates to higher insurance costs. The first step to managing premiums is understanding the specific factors that define a business as a high-risk profile from an underwriter's perspective.

Advanced Risk Modeling and Its Impact

Insurers have moved beyond relying solely on historical loss data. They now use advanced catastrophe (CAT) models that simulate thousands of potential weather scenarios to stress-test a business's resilience.

These models analyze the potential impact of events like a Category 4 hurricane making landfall near Freeport or a multi-day ice storm shutting down Dallas. They incorporate granular details—such as a building's construction materials, roof age, and proximity to the coast—to calculate a "probable maximum loss" (PML) estimate. This forward-looking approach is why rates can increase even in the absence of a recent local disaster. For a deeper analysis, see our article on analytics for the insurance industry.

The Global Reinsurance Market Ripple Effect

Events on a global scale can directly impact insurance costs in Texas. Local insurance carriers purchase their own coverage from a global market of companies called reinsurers.

When large-scale catastrophes, such as typhoons in Asia or wildfires on another continent, occur, they draw capital from this global reinsurance pool. For example, in the first half of one recent year, global insured losses from natural disasters reached $80 billion—nearly double the 10-year average. This strains reinsurance capacity, leading reinsurers to increase their pricing. These costs are then passed down to primary insurers and, ultimately, to policyholders in Texas. This demonstrates the interconnectedness of the global financial ecosystem.

Sector-Specific Risk Profiles for Key Texas Industries

Natural disasters do not impact all industries equally. A hurricane striking a coastal refinery creates a different set of financial and operational challenges than a drought affecting West Texas farmland. Building an effective financial safety net begins with a clear-eyed assessment of an industry's unique vulnerabilities.

The scale of these events is significant. In the first six months of a recent year, natural disasters caused $126 billion in economic damages in the U.S. alone—nearly triple the historical average. As these figures climb, an industry-specific risk perspective is essential for survival. The global impact of these rising costs highlights the broader financial context.

Energy and Petrochemical

For the Texas energy sector, the primary risk is business interruption caused by hurricanes. A facility on the Gulf Coast is exposed to storm surge that can inundate critical infrastructure and high winds that can damage pipelines and processing units.

The financial impact extends beyond physical repairs. A forced shutdown triggers a cascade of losses, including lost production revenue and potential penalties for failure to meet supply contracts. This is why Business Interruption coverage is a non-negotiable component of any comprehensive risk management plan for this sector.

Agriculture

Agricultural producers face a different set of threats, including slow-moving disasters like drought and extreme heat, as well as sudden events like flash floods and hail. A prolonged drought can lead to total crop failure, while a single hailstorm can destroy a season's worth of cotton or vegetables in minutes.

These events directly impact revenue-generating assets—crops and livestock. This risk profile requires specialized financial protection, typically involving crop insurance policies structured to cover yield losses resulting from adverse weather.

Construction and Logistics

An active construction site is highly vulnerable to high winds and torrential rain. Unfinished structures, unsecured materials, and heavy equipment are all exposed. A single severe storm can cause significant project delays and massive replacement costs.

For the logistics industry, the primary risk is supply chain paralysis. Flooded highways, damaged rail lines, and closed ports can halt the movement of goods. Even if a company's warehouse is undamaged, its operations are interrupted if its transportation network is disabled. This underscores the interconnected nature of risk, where one company's physical damage becomes another's operational shutdown.

These scenarios demonstrate that a generic disaster policy is insufficient. An effective risk management strategy must be tailored to the specific ways that weather events impact a company's unique operations, assets, and revenue streams.

Building Resilience That Goes Beyond an Insurance Policy

While appropriate insurance for natural disaster is a necessity, it functions as a reactive financial tool that facilitates recovery after damage has occurred.

True operational resilience is built long before a storm appears in the forecast. For business leaders in Texas, this requires a strategic shift from planning for recovery to actively minimizing the potential impact of a disaster.

These proactive investments not only protect personnel and physical assets but also signal to insurers a serious commitment to risk management, which can improve an organization's financial standing.

Proactive Measures to Fortify Operations

Investing in physical and operational resilience provides tangible safeguards that extend far beyond any policy document and can be decisive when extreme weather strikes.

Key areas of focus include:

- Robust Disaster Response Planning: An effective plan is a living document, tested through regular drills, supported by clear communication protocols, and backed by pre-negotiated agreements with emergency service vendors. A well-rehearsed plan is the best defense against operational chaos.

- Weather-Resilient Infrastructure: This can range from reinforcing roofs to withstand higher wind loads to elevating critical equipment above potential flood levels. Backup power generation is another essential component. Understanding the safety of steel buildings in storms, bad weather, lightning, and snowstorms can inform structural decisions that significantly reduce potential damage.

- Advanced Weather Forecasting and Monitoring: Early warning of severe weather is a strategic advantage. Sophisticated monitoring tools provide the necessary lead time to secure a construction site, reroute logistics, or execute a safe shutdown of critical operations before a storm's arrival.

Integrating climate resilience into core business strategy is no longer optional for long-term success in Texas. It transforms risk management from a cost center into a strategic advantage, protecting both your physical assets and your bottom line.

Ultimately, these proactive steps are what create an operation built to last.

Frequently Asked Questions

Common questions from Texas business leaders regarding natural disaster risk and insurance.

What’s the First Step in Evaluating Our Disaster Insurance Needs?

The first step, before engaging a broker, is to conduct a thorough risk assessment to understand your specific vulnerabilities.

Begin by quantifying the potential financial impact of a major hurricane, flood, or winter storm on your Texas operations. This analysis should include property damage, equipment losses, and the significant cost of business interruption. A clear, data-driven picture of your exposure is essential for a productive discussion about insurance needs.

Why Are Our Premiums Increasing Even Without a Recent Local Disaster?

Premium costs are influenced by broad global and regional trends, not solely by a company's individual claims history. Insurers use predictive models that account for growing risk factors across the board.

These models incorporate the rising concentration of asset values in high-risk areas like the Texas coast and the increasing severity of weather events. Furthermore, a major catastrophe elsewhere in the world can strain the global reinsurance market. This increases costs for primary insurers, which are then passed down to policyholders, including those in Texas.

Can We Lower Our Insurance Costs?

Yes, by actively managing and improving your risk profile. The goal is to be viewed as a lower-risk client from an underwriter's perspective.

Proactive measures such as reinforcing building structures, elevating critical equipment above potential flood levels, and implementing a well-documented emergency response plan can make a significant difference. These investments not only mitigate potential damage but also demonstrate to insurers that you are a responsible partner, which can often lead to more favorable terms.

Important Disclaimer: ClimateRiskNow is not an insurance provider or financial advisor. The information in this article is for educational purposes only. We strongly recommend consulting with qualified risk management and insurance professionals to assess your company’s specific needs and to obtain advice on financial products.

At ClimateRiskNow, we provide the data-driven clarity you need to move from reactive recovery to proactive resilience. Our Sentinel Shield platform delivers location-specific weather risk intelligence, quantifying your operational exposure to events like hurricanes, floods, and freezes so you can make informed strategic decisions. Safeguard your assets and ensure business continuity by understanding your true risk.