For business leaders in Texas, the increasing frequency and intensity of natural disasters are no longer a future concern—they are a present-day reality impacting operational stability and financial performance. This new normal directly links climate change and natural disasters, creating measurable risks for companies across key sectors like Energy, Manufacturing, Logistics, Agriculture, and Construction.

Understanding this connection is the first step toward safeguarding your assets, protecting your personnel, and ensuring your company's long-term viability.

The New Business Reality of Texas Climate Risk

The dialogue around climate change has shifted from academic debate to the corporate boardroom. Extreme weather events, intensified by a changing climate, are now a primary driver of operational disruptions and economic losses in Texas.

For decision-makers in the Energy & Petrochemical, Manufacturing, or Agriculture sectors, overlooking these trends is no longer a viable strategy. The data reveals an escalating threat that demands a sophisticated, data-driven risk management framework.

This guide provides actionable insights to help Texas executives move from reactive crisis management to building an organization resilient enough to withstand future climate shocks. We will examine how these events impact financial performance, supply chain integrity, and sustainable growth.

A Pattern of Escalating Threats

Recent data underscores the urgency. The U.S. has experienced 403 separate billion-dollar weather and climate disasters since 1980, with a total cost exceeding $2.9 trillion.

What is most concerning for strategic planning is the accelerating frequency of these events. The average annual cost over the last five years has reached $149.3 billion, more than double the 45-year average.

This pattern signals a new operational environment where preparing for a "once-in-a-century" event is an annual requirement. The key takeaway for executives is that historical weather data is no longer a reliable predictor of future risk. Your strategic planning must now account for:

- Increased Frequency: More billion-dollar disasters are occurring each year.

- Greater Intensity: Storms, floods, and heatwaves are becoming more powerful and destructive.

- Compounding Risks: Disasters often occur in succession, leaving insufficient time for recovery.

Proactive Preparation Is a Business Imperative

This new reality demands a fundamental shift in risk management. Proactively addressing these threats is not merely an expense; it is a critical investment in operational continuity and profitability.

By understanding your business's specific vulnerabilities, you can develop targeted strategies to mitigate damage and accelerate recovery. For a deeper analysis, review our guide on essential climate change adaptation strategies for businesses.

Disclaimer: The information provided in this article is for educational purposes only and is not intended as financial advice or an insurance recommendation. ClimateRiskNow does not sell insurance or financial products. We equip business leaders with data and insights to make informed decisions about operational risk.

How a Changing Climate Fuels Extreme Texas Weather

To build effective operational resilience, decision-makers must first understand the physical mechanics driving more frequent and intense extreme weather. This is not a theoretical exercise; it is about connecting climatic shifts to the tangible risks threatening your facilities, supply chains, and workforce. A firm grasp of these drivers enables a transition from reactive crisis response to strategic, proactive risk mitigation.

A warmer global atmosphere holds more moisture, a simple physical principle with significant consequences for Texas industries. This directly fuels more intense rainfall events and the kind of widespread flooding that can halt logistics and inundate critical infrastructure.

The Hurricane Amplifier: Warmer Gulf Waters

A direct and potent link exists in the Gulf of Mexico. Warmer ocean waters act as high-octane fuel for hurricanes. As sea surface temperatures rise, they transfer more energy to developing storms, enabling rapid intensification and higher sustained wind speeds.

This translates into storms that are not only stronger but also wetter. A hurricane drawing moisture from an abnormally warm Gulf can produce staggering rainfall totals, as demonstrated by Hurricane Harvey. The result is catastrophic inland flooding, threatening manufacturing plants, distribution centers, and agricultural operations previously considered outside of coastal risk zones.

The intensification of tropical cyclones is a primary concern for Texas coastal industries. Warmer oceans don't just create stronger winds; they escalate the risk of storm surge and compound flooding, threatening critical infrastructure in the Energy and Petrochemical sectors.

Unstable Jet Streams Locking in Extreme Conditions

Another significant factor is the changing behavior of the jet stream, the high-altitude air current that governs weather patterns. The Arctic is warming faster than the equator, reducing the temperature differential that drives the jet stream. This causes it to weaken and become wavier, leading to more persistent and extreme weather patterns.

This instability creates significant operational challenges for Texas businesses:

- Prolonged Heat Domes: A sluggish jet stream can trap high-pressure systems over Texas for extended periods, creating dangerous heat domes. This places immense strain on the electrical grid, increases cooling costs for facilities, and creates hazardous conditions for outdoor workers in construction and agriculture.

- Intensified Droughts: The same blocking patterns can divert storm tracks away from the state, leading to severe droughts. This impacts agricultural yields, strains water availability for industrial processes, and elevates wildfire risk across the state.

Understanding these complex interactions is essential for accurate risk forecasting. To learn about the advanced tools used in these predictions, see our overview of how weather computer models work.

From Atmospheric Moisture to Operational Disruption

Ultimately, the connection between climate change and natural disasters is a clear cause-and-effect chain. Increased heat energy in the atmosphere and oceans amplifies the natural weather systems that affect Texas. Storms become stronger, rainfall more intense, and weather patterns more extreme and persistent.

For business decision-makers, understanding these drivers is the foundational step toward building a resilient enterprise. It reframes disasters from random events into predictable, intensifying risks that can be strategically managed. These are the practical mechanics creating real-world financial and operational risks for your company today.

Mapping Climate Threats to Key Texas Industries

A general understanding of climate change is insufficient for effective corporate strategy. For a business leader in Texas, the critical question is, "How does this specifically impact my operations and bottom line?"

Effective risk management must be sector-specific. The vulnerabilities of a coastal petrochemical facility are fundamentally different from those of a Central Texas agricultural operation or a Dallas-based logistics hub. Identifying your industry’s unique risk profile is the essential first step toward building genuine operational resilience.

The consequences of extreme weather are not evenly distributed; they exploit specific weaknesses in your operations, whether a supply chain chokepoint, an overburdened HVAC system, or a project timeline exposed to weather delays.

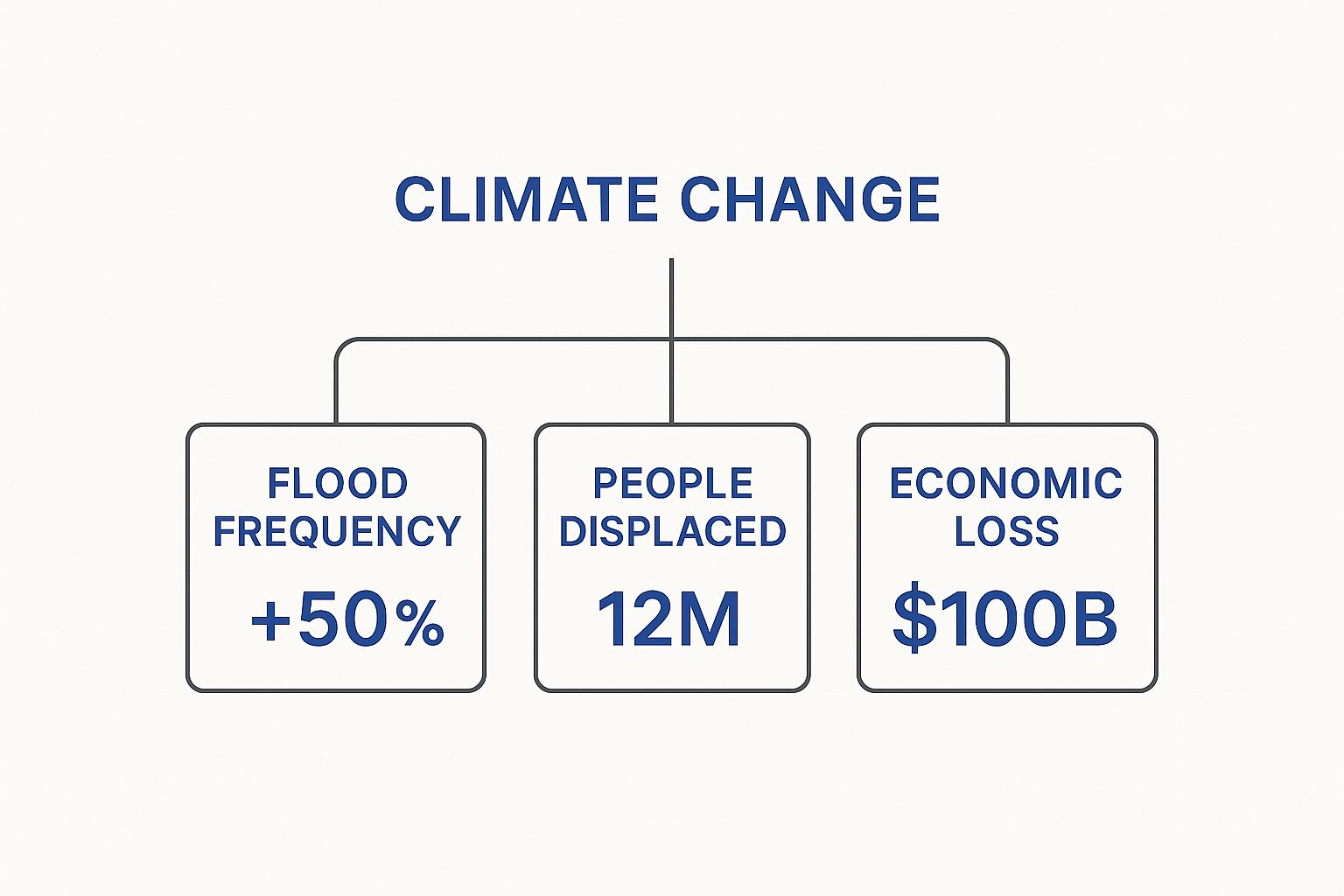

This illustrates the direct line from a changing climate to tangible, high-cost outcomes that disrupt commerce and communities. To make this more concrete, we have broken down the primary threats and operational risks for the industries that form the backbone of the Texas economy.

Climate Risk Matrix for Key Texas Industries

| Industry Sector | Primary Disaster Threat | Key Operational Risks |

|---|---|---|

| Energy & Petrochemical | Hurricanes, Extreme Heat | Facility shutdowns, supply chain disruption, equipment failure, regulatory scrutiny |

| Manufacturing & Logistics | Inland Flooding, Heat Waves | Transportation blockage, production halts, workforce safety issues, inventory damage |

| Agriculture | Drought, Flash Floods | Crop failure, livestock stress, soil erosion, water shortages, commodity price volatility |

| Construction | Extreme Heat, Heavy Rain | Project delays, unsafe work conditions, material cost inflation, budget overruns |

This matrix provides a high-level snapshot. Now, let's analyze what these risks mean for each sector's operations.

Energy and Petrochemicals Under Pressure

The Texas Gulf Coast, the epicenter of America’s energy and petrochemical industry, is exceptionally vulnerable to climate-related risks. Refineries, processing plants, and export terminals are directly exposed to the dual threats of high-intensity hurricane winds and catastrophic storm surge. A single major storm can trigger widespread shutdowns, creating shocks throughout global supply chains and resulting in billions in economic losses.

Beyond acute storm risk, a chronic threat is extreme heat. Prolonged heat waves strain cooling systems, reduce equipment efficiency, and increase the risk of unplanned outages—directly impacting revenue in an industry dependent on continuous, precise operations. Protecting this vital hub is a matter of national importance; learn more in our guide to critical infrastructure protection.

Manufacturing and Logistics: Supply Chain Fractures

For manufacturers and logistics operators, the primary vulnerability is often not the facility itself but the network of highways, rail lines, and ports that underpin the supply chain. Intense rainfall and subsequent flooding can render key transportation arteries impassable, severing critical links for days.

A flooded Interstate 10 is not just a delayed shipment; it's a domino effect that halts production lines, depletes warehouse inventories, and can lead to costly contractual penalties. Furthermore, extreme heat poses significant health and safety risks for workers in non-climate-controlled environments, reducing productivity and increasing liability exposure.

Agriculture Facing Dual Threats

The Texas agriculture sector is caught between two devastating extremes: crippling drought and destructive flash floods. Extended dry periods intensified by record heat deplete water resources, wither crops, and stress livestock, directly reducing yields and increasing operational costs.

Conversely, when precipitation does occur, it often arrives as intense downpours that cause flash flooding. These events erode topsoil, destroy harvests, and damage essential farm infrastructure. This volatile cycle makes long-term planning exceedingly difficult and threatens the stability of the state's food and fiber supply.

Construction: Project Delays and Shifting Demands

In the construction sector, extreme weather translates directly into project delays and budget overruns. Intense heat waves create unsafe working conditions, forcing work stoppages and reducing productivity. A few days of heavy rain can saturate a job site, sidelining heavy machinery and delaying foundational work for weeks.

These weather-driven disruptions are now so frequent they must be integrated into project timelines and cost estimates. Concurrently, the increasing reality of climate change natural disasters is driving demand for climate-resilient building codes and designs, compelling the industry to innovate with more durable methods and materials.

The Rising Financial Toll of Extreme Weather Events

For Texas business leaders, the financial implications of climate risk are no longer abstract. The steady increase in both the frequency and severity of extreme weather now translates into quantifiable costs on the balance sheet.

The data reveals a clear financial trend. The era of treating major natural disasters as rare, "black swan" events is over. Investing in resilience is no longer an optional expenditure—it is a core component of sound financial management.

The New Math of Billion-Dollar Disasters

The sharp increase in billion-dollar weather events provides compelling evidence of this new reality. Since 1980, the United States has been impacted by 403 separate weather and climate disasters with damages exceeding $1 billion each.

The total cost of these events now surpasses $2.9 trillion. For Texas executives, the most critical data point is the rate of acceleration. Over the last five years, the average annual cost of these disasters has been $149.3 billion—more than double the 45-year average. The financial risk from climate change natural disasters is not just growing; it is compounding.

For a Texas business, this means the historical data once used for risk planning is becoming obsolete. The "100-year flood" is now a recurring threat, and the financial impact of a single hurricane or winter storm can erase years of profitability.

This is a global trend. Between 1970 and 2000, the average direct global cost of disasters was approximately $70–$80 billion annually. From 2001 to 2020, that figure surged to $180–$200 billion per year.

From Direct Damage to Cascading Losses

The headline figures, while substantial, only represent a fraction of the total economic impact. The true cost of a disaster extends far beyond the initial repair bills. For industries like Manufacturing, Logistics, and Energy, the secondary and tertiary effects often inflict the most significant financial pain.

These cascading costs include:

- Business Interruption: Every hour of downtime due to power outages or transportation disruptions represents lost revenue.

- Supply Chain Disruption: A single point of failure—a damaged port or an impassable rail line—can halt production for weeks.

- Reputational Damage: Failure to fulfill contracts due to weather-related shutdowns can permanently erode customer trust and market position.

- Increased Operating Costs: Post-disaster, the cost of materials, labor, and transportation often spikes as regional demand outstrips supply.

With extreme weather becoming more common, efficient recovery is critical. Understanding processes like how to file a flood insurance claim can minimize financial disruption. As navigating coverage is a key component of risk management, we have compiled a detailed guide on the role of insurance in managing natural disaster risks.

Ultimately, the data presents an undeniable business case: the long-term, compounding cost of reacting to disasters now far exceeds the upfront investment in strategic resilience.

Building a Proactive Climate Resilience Plan

Understanding the risks posed by climate-driven natural disasters is the first step; translating that knowledge into an actionable plan is what safeguards your company’s future. For any Texas business, transitioning from a reactive posture to a proactive resilience strategy is now an operational imperative. The objective is to build an organization that not only survives an extreme weather event but also recovers quickly and emerges stronger.

This begins with a fundamental shift in mindset, treating disasters not as random acts but as foreseeable business risks that can be managed and mitigated. This requires an objective analysis of your specific vulnerabilities and the strategic implementation of measures to address them.

Starting with a Comprehensive Risk Assessment

A robust defense cannot be built without first identifying vulnerabilities. A comprehensive risk assessment is the foundation of any credible resilience plan, involving a granular analysis of how extreme weather could impact core operations.

This assessment must pinpoint vulnerabilities across three critical domains:

- Physical Infrastructure: How will your facilities—from manufacturing plants to data centers—withstand hurricane-force winds, storm surge, or flash flooding?

- Operational Processes: What are the critical choke points in your production or service delivery that are susceptible to failure during a prolonged power outage or extreme heat event?

- Supply Chain Networks: Which of your suppliers, shipping routes, or third-party logistics partners are located in high-risk zones? These dependencies can create systemic risk across your entire operation.

Answering these questions provides the data needed to prioritize capital allocation and build a plan that addresses your most significant threats first.

Developing Robust Business Continuity Plans

A generic, off-the-shelf continuity plan is inadequate for the specific climate threats facing Texas. Your strategy must be tailored to the most probable scenarios: hurricanes, widespread flooding, and severe heat events. Energy resilience is a critical component; understanding the trade-offs of backup power systems is essential for developing effective storm preparedness strategies.

A climate-focused business continuity plan must clearly define procedures for:

- Pre-Event Preparations: Actions to be taken when a major storm is forecast, including securing facilities and communicating with personnel.

- During-Event Operations: Protocols for maintaining mission-critical functions safely, potentially with a reduced workforce.

- Post-Event Recovery: A clear roadmap for damage assessment, system restoration, and a phased return to full operational capacity.

The urgency for these plans is increasing. Between 1980 and 2024, the U.S. experienced 403 billion-dollar weather disasters. The average time between these events has decreased from 82 days in the 1980s to just 19 days in the last decade, compressing the timeline for response and recovery.

Implementing Practical Mitigation Strategies

Once risks are mapped and continuity plans are structured, the next step is implementation. This involves tangible actions that enhance your business's physical and operational durability. The focus should be on practical, high-impact strategies that yield a measurable return on resilience.

A resilience plan is not a static document; it is a living strategy that must be regularly tested, updated, and integrated into your company's core operational culture. True resilience is built through continuous improvement and adaptation.

Consider these sector-specific examples:

- Asset Hardening: A construction firm might engineer new projects to exceed local wind-load standards. A petrochemical facility could elevate critical electrical equipment above projected flood levels based on forward-looking climate data.

- Supply Chain Diversification: A manufacturer can mitigate risk by qualifying alternative suppliers and transportation routes outside of primary disaster-prone corridors, building necessary redundancy.

- Updated Employee Safety Protocols: For businesses in Agriculture or Logistics, this includes implementing mandatory hydration and rest schedules during heat waves and providing personal cooling equipment.

By systematically identifying risks and deploying targeted solutions, you can build a durable framework for operational continuity. To guide this process, we have developed a comprehensive business resilience framework. This proactive approach transforms resilience from a cost center into a sustainable competitive advantage.

Answering Your Climate Risk Questions

Addressing climate risk can seem like a monumental task. As a Texas business leader, you understand the high stakes involved. Based on common questions from executives across key industries, we have compiled direct answers to help you develop a clear, strategic path forward.

This information is intended to provide practical, operational insight, not financial advice. The goal is to cut through the complexity and enable strategic action.

Where Do I Even Begin with a Climate Risk Assessment?

The initial step is often the most challenging. The key is to start with a focused scope. Instead of attempting to analyze every potential risk at once, concentrate on your most critical assets and operational bottlenecks.

Begin by addressing three foundational questions:

- Which single event would cause the most significant operational disruption? Is it a hurricane impacting coastal facilities? Inland flooding severing a primary logistics route? A prolonged heatwave that destabilizes the power grid?

- Which of our facilities or critical suppliers are located in known high-risk zones? Utilize publicly available resources like FEMA flood maps as a starting point to identify obvious vulnerabilities in your operational footprint.

- What were the key failure points during the last major weather event? Analyze your company's performance during events like Hurricane Harvey or Winter Storm Uri. These real-world stress tests provide the most valuable data on weaknesses in your existing continuity plans.

Answering these questions transforms a general sense of risk into a concrete, prioritized list of vulnerabilities, providing a clear starting point for a more detailed analysis.

How Do I Justify Resilience Investments to Stakeholders?

The key is to frame the discussion around value preservation and creation, not cost. When presenting to a board or executive team, position resilience as a strategic investment that protects revenue, ensures operational stability, and provides a competitive advantage. The language must be that of business: ROI, risk mitigation, and market opportunity.

Data is your most effective tool. Point to the escalating costs of inaction, such as the five-year average annual cost of U.S. billion-dollar disasters reaching $149.3 billion.

Frame resilience not as an expenditure, but as an essential investment in operational continuity. The cost of proactive preparation is consistently lower than the compounding financial and reputational losses that follow a catastrophic failure.

Build the business case around these core arguments:

- Cost of Downtime: Quantify the revenue lost per hour or day of a weather-induced shutdown.

- Access to Capital and Insurance: Demonstrate how a documented resilience strategy can lead to more favorable terms from lenders and insurers, who increasingly price climate risk into their financial products.

- Market Share Protection: In the aftermath of a regional disaster, the businesses that recover and resume operations first are positioned to capture market share from less-prepared competitors.

This data-driven approach reframes resilience from a defensive cost into a forward-thinking strategy for financial strength and market leadership.

What Is a Realistic First Step for Building a Climate-Ready Culture?

Building a resilient culture does not require a massive, top-down overhaul. The most effective method is to start small by integrating climate risk considerations into existing business processes and routines.

Embed climate-aware thinking into your team's existing workflows:

- Incorporate weather threats into safety briefings. When discussing workplace safety, include protocols for heat stress during summer months or review flood evacuation routes. This makes climate risk a tangible part of daily operations.

- Add a climate diligence question to project planning. When evaluating a new facility location or supply chain partner, make it standard practice to ask, "How have we assessed the impact of extreme weather on this decision?" This normalizes climate as a key business variable.

- Conduct a simple tabletop exercise. Gather a key operational team to walk through a hypothetical scenario, such as a multi-day power outage following an ice storm. This low-stakes simulation is a highly effective way to identify gaps in your current plans before a real crisis occurs.

These incremental steps foster a sense of shared responsibility for resilience, building awareness and capability from the ground up and creating a stronger foundation for future challenges.

Turning complex climate data into a clear strategic advantage is what ClimateRiskNow does. Our Sentinel Shield platform provides Texas businesses with location-specific risk assessments that quantify your exposure to hurricanes, flooding, extreme heat, and more, so you can stop guessing and start preparing.

Discover how to safeguard your assets and ensure operational continuity. Request your customized Sentinel Shield assessment today.