Risk assessment methodologies are not academic exercises—they are structured frameworks that turn the abstract threat of extreme weather into a concrete, manageable business strategy. For any industry in Texas, from energy to construction, applying the right method is what separates a business that reacts to a crisis from one that proactively builds resilience against it.

Why Your Texas Business Needs a Structured Risk Approach

For business leaders in Texas, operational risk is a recurring reality, driven by increasingly severe weather that impacts everything from petrochemical complexes on the Gulf Coast to manufacturing hubs in North Texas. The financial stability and operational continuity of these key industries are now directly tied to the climate. A 2021 winter storm, for example, caused an estimated $130 billion in economic damage across the state, highlighting the immense vulnerability of unmitigated weather risks.

Simply acknowledging these threats is not enough. Survival and growth demand a structured approach, and choosing the correct risk assessment methodologies is the first critical step in turning a vulnerability into a strategic advantage. This guide will walk you through the primary methods, showing how each one applies to the specific challenges Texas businesses face today—without getting lost in technical jargon.

The Foundation of Modern Risk Management

The practice of formally assessing risk has evolved alongside commerce and industry. Its roots began to formalize in the 18th century with advances in actuarial science and have since grown into the robust frameworks we use today.

What does that mean for your business? It means you can build on proven principles to protect your assets, supply chain, and workforce. We'll break down the essentials:

- Qualitative Assessment: How to quickly identify and rank risks using expert judgment, ideal for initial evaluations.

- Quantitative Assessment: How to assign a real dollar value to risks to build a business case for mitigation investments.

- Hybrid Approaches: How to blend both methods for a strategy that is both balanced and effective.

Disclaimer: The information provided by ClimateRiskNow is for educational purposes only. It is not intended as, and should not be interpreted as, financial advice or a recommendation for any specific insurance products. ClimateRiskNow does not sell insurance or financial products. We strongly encourage you to consult with qualified financial and insurance professionals to address your specific needs.

Ultimately, mastering these approaches allows you to make informed decisions that safeguard your operations and bottom line. A good place to start is by understanding the range of available climate risk assessment tools that can support these methodologies.

Qualitative Risk Assessment: Your First Practical Step

For Texas business leaders, getting a handle on operational risk doesn't have to start with complex financial models. The most practical first move is often a qualitative risk assessment. This method uses descriptive scales to size up the likelihood and impact of a potential event, allowing you to quickly sort and prioritize threats based on expert judgment and operational experience.

Instead of precise dollar figures, you use simple categories like "High," "Medium," and "Low," or a numeric scale from 1 to 5. The main goal is to separate immediate dangers from background noise. It's a fast, cost-effective way to get a bird's-eye view of your vulnerabilities, making it the perfect starting point for any organization.

How It Works in Texas Industries

The real power of a qualitative assessment is how it works on the ground, providing a framework for quick, smart calls when conditions change.

Let's look at some real-world Texas scenarios:

- Construction: A Dallas project manager sees a severe hailstorm on the forecast. Using a simple risk matrix, they instantly tag the event's likelihood as "High" and its potential impact on materials and timelines as "High." This swift judgment call triggers action—securing materials and moving vehicles under cover.

- Logistics: A Houston-based coordinator receives a hurricane warning for the Gulf Coast. They quickly assess the chance of port closures as "Very High" and the supply chain impact as "Critical." This allows them to start rerouting shipments and warning clients long before any financial loss calculations are available.

- Agriculture: A West Texas farm owner faces a prolonged drought. The likelihood is "High," and the impact on crop yield is "Severe." That qualitative assessment drives immediate strategic decisions on water conservation, sourcing feed, and adjusting planting schedules.

By focusing on descriptive ratings, qualitative assessment provides a clear, shared language for risk. It allows a diverse team—from the plant floor to the executive suite—to discuss and understand threats without getting bogged down in complex calculations, ensuring everyone is aligned on priorities.

This approach is especially critical for risks where good data is hard to come by, such as reputational damage or employee morale after an operational shutdown.

Pros and Cons of a Qualitative Approach

Like any of the risk assessment methodologies, the qualitative approach has its strengths and weaknesses. Its biggest advantage is speed and simplicity.

Key Advantages:

- Fast Implementation: You can roll it out quickly without needing specialized software or a team of statisticians.

- Cost-Effective: It requires fewer resources, making it accessible for businesses of all sizes.

- Encourages Collaboration: It naturally brings in experts from different departments, providing a more complete picture of your risks.

The main drawback, however, is its subjectivity. Because it leans on human judgment instead of hard data, results can vary depending on who is involved. This can make it tricky to run a precise cost-benefit analysis on mitigation efforts. Even with that limitation, it’s an essential first step that shines a light on the critical few risks that may warrant a deeper, quantitative look later on.

Quantitative Risk Assessment: Putting a Price on Risk

While qualitative assessment helps you prioritize risks, quantitative risk assessment speaks the language of the boardroom: dollars and cents. This is where we move beyond "high," "medium," and "low" to assign real financial figures to potential threats. It’s the kind of hard data you need to build an ironclad business case for action.

For Texas industries facing tangible threats from extreme weather, this method changes the conversation from "this could be bad" to "this could cost us $1.5 million in downtime and repairs." When you put a price tag on a risk, you can run a clear cost-benefit analysis on any proposed mitigation, making it easier to justify spending on backup generators, reinforced structures, or improved drainage systems.

Calculating the Financial Impact of Weather Risks

Quantitative risk assessment relies heavily on historical data, financial records, and statistical probability to measure risk in monetary terms. A key formula is the Annualized Loss Expectancy (ALE), which rolls asset value, potential damage, and frequency into a single, powerful dollar figure.

Let's walk through a real-world Texas scenario:

- The Situation: A petrochemical plant in Freeport relies on a single water pump to cool critical equipment. With extreme heatwaves becoming more common, the chances of that pump failing are rising.

- Asset Value (AV): The production line dependent on this pump is worth $10,000,000.

- Exposure Factor (EF): If the pump fails, the plant estimates it will lose 20% of the production line's value to downtime and emergency repairs. This gives us a Single Loss Expectancy (SLE) of $2,000,000 ($10,000,000 x 0.20).

- Annualized Rate of Occurrence (ARO): Based on climate projections and recent heatwave frequency, a failure-inducing event is now expected once every four years. This gives us an ARO of 0.25.

- Annualized Loss Expectancy (ALE): Multiplying the SLE by the ARO results in an ALE of $500,000 per year ($2,000,000 x 0.25).

Suddenly, the decision becomes clear. With a $500,000 annual risk on the books, a proposal to invest $1.2 million in a redundant, heat-resistant pumping system makes perfect business sense. The investment pays for itself in under three years, turning a vague threat into a quantifiable problem with a clear ROI.

The Role of Data in Quantitative Analysis

This methodology lives and dies by the quality of the data behind it. For more on how this fits into the bigger picture, check out our complete guide to strategic operational risk management.

The true power of quantitative risk assessment is its ability to create objective, defensible arguments for risk mitigation. When you can show stakeholders that a specific weather event carries a $500,000 annualized risk, the discussion shifts from whether to act to how quickly you can implement a solution.

For businesses in Texas, this crucial data can be pulled from several key sources:

- Internal Records: Maintenance logs, production reports, and financial statements.

- Historical Climate Data: Agencies like NOAA provide extensive records on past weather events.

- Industry Benchmarks: Data on how similar events have impacted other companies in your sector.

Gathering and analyzing this data takes more effort than a qualitative review, but the clarity and authority it brings to your decision-making are unmatched. It gives leadership the confidence to allocate resources effectively, protecting the business from the most significant financial threats posed by a changing climate.

How to Choose the Right Methodology for Your Business

Picking the right risk assessment methodology is a strategic decision that dictates how well you can protect your Texas operations. The best approach isn't a one-size-fits-all solution; it depends on your company's data availability, resources, and the level of detail needed to make smart decisions.

The goal is to align the tool with the task. Do you need a quick, high-level overview to flag your most obvious threats? Or do you need hard numbers to justify a major investment to your board? A family-owned farm in Central Texas can use a qualitative approach to quickly map out drought threats, while a major energy company on the Gulf Coast needs a rigorous quantitative analysis to get approval for multi-million-dollar flood defense upgrades.

A Practical Comparison for Texas Leaders

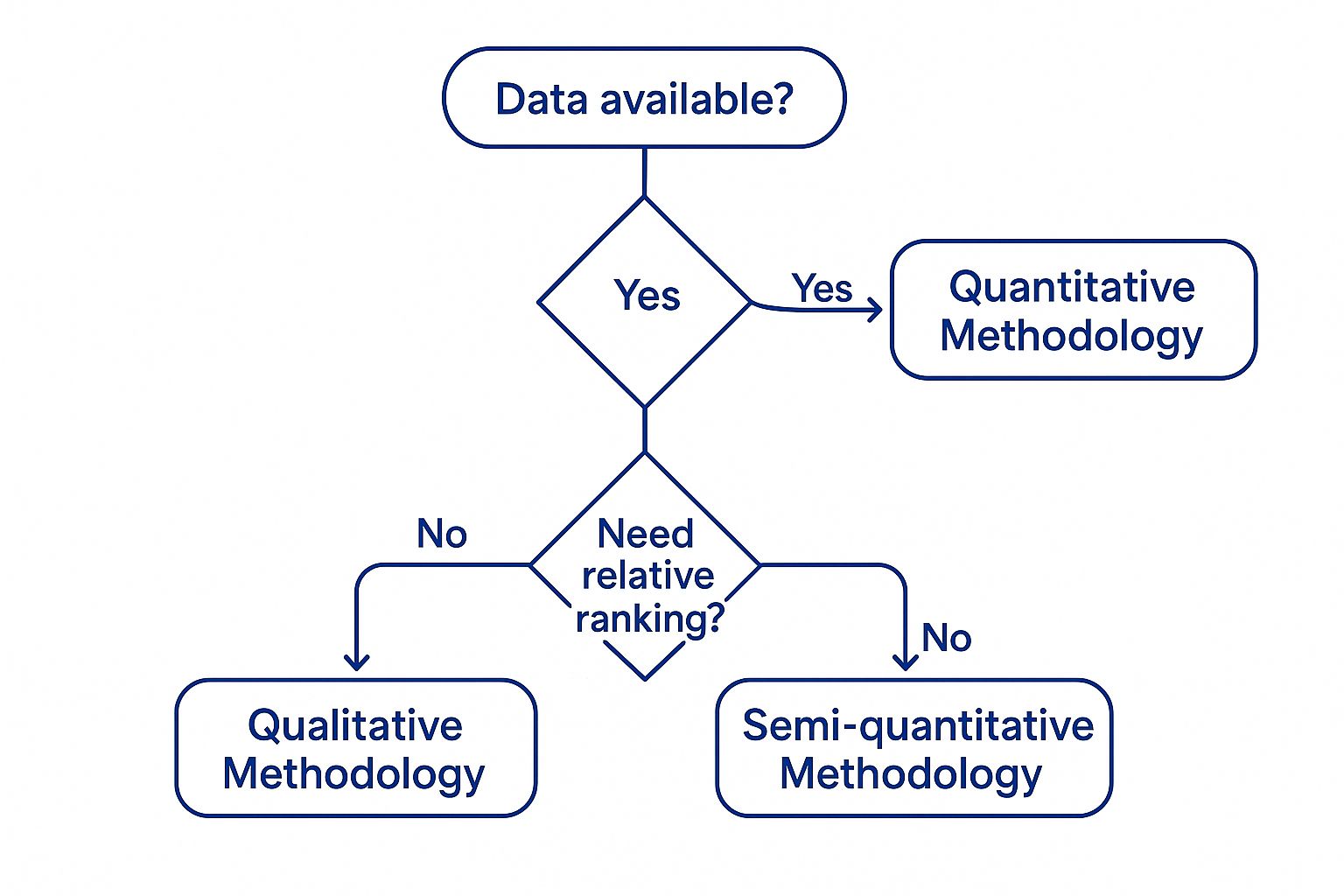

This decision tree breaks down the core questions that will guide you toward the right risk assessment methodologies for your situation.

The single biggest factor is often whether you have reliable data. That alone can determine if a quantitative approach is feasible. Getting this choice right is crucial for building a resilient organization and informs everything from what is business continuity planning to its execution.

Qualitative vs. Quantitative Risk Assessment

| Attribute | Qualitative Assessment | Quantitative Assessment |

|---|---|---|

| Data Needs | Low. Relies on expert opinion, experience, and industry knowledge. | High. Requires historical data, financial records, and climate projections. |

| Complexity | Simple and intuitive, easily understood across all departments. | More complex, often requiring specialized skills in data analysis and modeling. |

| Budget & Time | Fast and cost-effective, ideal for quick initial assessments. | Resource-intensive, requiring more time, personnel, and potentially software. |

| Primary Output | A prioritized list of risks (e.g., High, Medium, Low). | Specific financial figures (e.g., Annualized Loss Expectancy). |

| Best For | Rapidly identifying and ranking a broad range of potential threats. | Building a financial business case for specific, high-cost mitigation projects. |

| Texas Example | A construction firm quickly ranking hailstorm risk to a project site. | A manufacturing plant calculating the exact cost of a week-long power outage. |

The takeaway is not about which method is "better," but which is right for the job today. Many Texas businesses get the best results by starting with a qualitative assessment to map the risk landscape, then using a targeted quantitative approach for the highest-priority threats. This pragmatic strategy ensures you’re both comprehensive and precise where it matters most.

The Hybrid Approach: Blending Practicality with Precision

For business leaders in Texas, picking a risk assessment method doesn't have to be an either-or choice. The smartest approach often combines the strengths of both qualitative and quantitative analysis. This hybrid approach delivers a high-level overview and the solid data you need to make confident decisions.

You start with the wide-angle view of a qualitative assessment to quickly scan your entire operational landscape for weather-related threats. This helps you separate minor headaches from mission-critical dangers.

Once you have that prioritized list, you switch to a more focused, quantitative analysis for only the most severe threats. This means you spend your resources calculating the financial impact of the risks that truly matter, instead of getting bogged down quantifying every minor concern.

A Texas Logistics Firm in Action

Let’s see how this works for a logistics company headquartered in Houston. The leadership team knows extreme weather is their single biggest operational threat.

They start with a qualitative assessment, bringing in managers from warehousing, fleet operations, and client relations. In a workshop, they use an impact-likelihood matrix to rank risks. "Port closures from a Category 3+ hurricane" is immediately flagged as a High-Impact, High-Likelihood risk.

With that priority set, they pivot to a quantitative analysis for that specific threat, calculating the potential financial fallout from:

- Daily losses from rerouted trucks and idle drivers.

- Penalties for failing to meet delivery deadlines.

- The cost of securing alternative warehousing further inland.

The final calculation shows a five-day port closure could cost them over $2 million. That hard number provides the undeniable business case to justify a strategic investment in diversifying shipping routes through ports less vulnerable to Atlantic storms. This is the power of the hybrid approach—it connects a qualitative gut-check to a data-driven, financially sound solution.

A hybrid model provides the gold standard for real-world risk management. It uses the speed of qualitative methods to ensure no major threat is missed, then applies the financial precision of quantitative analysis only where it will have the greatest strategic impact.

Leveraging Data for a Clearer Picture

The effectiveness of any hybrid strategy hinges on good data. By analyzing past weather events and their impacts, you can spot patterns that inform what might happen next. For example, local regulatory bodies like the Texas Commission on Environmental Quality (TCEQ) have reporting requirements that can serve as a data source for environmental risk impacts. Modern tools can take this further, using machine learning to process huge historical datasets. You can discover more insights about leveraging historical data in risk assessments on sbnsoftware.com.

This blend of broad identification and deep, data-driven analysis makes the hybrid approach a cornerstone of effective planning. To see how this fits within a larger framework, explore our guide on business risk management strategies. This allows you to create a plan that is both comprehensive and actionable, preparing your organization for whatever the weather brings.

Putting Your Risk Assessment Plan into Action

Knowing the theory behind risk assessment is one thing; turning that knowledge into a plan that builds real resilience for your Texas business is another. An effective risk management program is a living process baked into your company’s strategic core. The goal is to move from reacting to threats to proactively anticipating them.

This demands a structured framework you can apply and refine over time. When you embed this into your culture, risk management stops being a task and becomes a continuous strategic advantage.

Key Steps for Implementation

To get your risk assessment off the ground, you need a clear path from planning to long-term monitoring.

Assemble a Cross-Functional Team: Pull together a diverse group of stakeholders from operations, finance, logistics, and facilities. A construction site manager in Dallas will see hail risk differently than a CFO in Austin; you need both perspectives.

Clearly Define the Scope: Decide exactly what you’re assessing. Is it a single facility, a specific supply chain route, or your entire Texas operation? A tight scope, like "flood risk at our Houston petrochemical plant," is far more manageable and delivers more actionable insights.

Gather and Analyze Data: Collect the information needed for your chosen methodology. For a qualitative assessment, this might mean running workshops with your expert team. For a quantitative one, it means digging into historical weather data, asset valuations, and maintenance records to calculate potential financial losses.

From Analysis to Action

Once your analysis is complete, the most critical phase begins: communicating findings and driving action. An assessment is only valuable if it leads to real changes that make your business less vulnerable to extreme weather. Present your findings to leadership in straightforward, business-focused terms. A prioritized risk list or a compelling ROI is what secures the buy-in needed for mitigation projects.

Risk assessment isn't a one-and-done project—it's a continuous cycle. The business environment and climate threats are always changing, so your risk posture must be regularly monitored, reviewed, and adapted to new information.

This ongoing loop of assessment and improvement is fundamental to any solid business continuity strategy. For a deeper dive, check out our guide on how to create a disaster recovery plan that aligns with your risk assessment findings.

Answering Your Key Questions

Getting a handle on the different risk assessment methodologies is one thing, but Texas business leaders always want to know how to put these ideas into practice. Let's tackle some of the most common questions.

How Often Should We Conduct a Risk Assessment

A full risk assessment should be conducted at least annually to stay current with business and climate changes. However, you must reassess whenever a significant change occurs, such as opening a new facility, major shifts in Texas environmental regulations (e.g., updates from the TCEQ), or new climate data indicating increased weather threats. For your highest-priority risks, a quarterly check-in is a smart best practice to ensure operational security.

What Is the Biggest Mistake Companies Make

The most common mistake is treating risk assessment as a "check-the-box" compliance exercise. This mindset misses the strategic value. Real risk management must be a living process integrated into your operational planning and capital investments. Another critical error is keeping the process siloed. A logistics manager in the Permian Basin and a plant supervisor on the Gulf Coast see different threats; you need both at the table for a comprehensive view.

The goal is to build a living risk management culture, not to generate a report that sits on a shelf. An assessment’s true value is realized when its insights drive proactive, informed decisions across every level of the business.

Can We Perform a Risk Assessment Without Much Historical Data

Absolutely. While deep historical data is ideal for quantitative analysis, its absence doesn't leave you flying blind. This is where qualitative risk assessment methodologies prove their worth. When you lack hard numbers, rely on other powerful insights:

- Expert Opinion: Tap into the deep, on-the-ground knowledge of your veteran employees.

- Industry Benchmarks: Analyze what happened to other companies in your sector during similar weather events.

- 'What-If' Scenarios: Conduct structured workshops to brainstorm and game out potential threats.

For new and evolving risks like changing weather patterns, this kind of forward-looking, qualitative approach is essential for building a resilient business.

Ready to move from theory to action with location-specific weather risk intelligence? The ClimateRiskNow Sentinel Shield platform provides actionable data tailored to Texas industries. Safeguard your assets and ensure operational continuity by understanding your unique exposure to extreme weather events.