For business decision-makers in Texas, a hurricane is not just a weather event; it is a significant operational threat with severe financial implications. As recurring natural disasters, hurricanes necessitate a proactive risk management strategy that is integral to long-term business continuity in the state’s key industries.

Understanding Hurricane Risk Exposure in Texas

For executives in the Energy, Manufacturing, Logistics, Agriculture, and Construction sectors, hurricane threats must be evaluated strategically. The risk extends far beyond physical asset damage, creating a cascade of failures that can halt operations, from crippled public infrastructure to fractured supply chains.

The financial toll of these storms is staggering. Since 1980, Texas has experienced more billion-dollar natural disasters than any other state, accumulating damages estimated at over $436 billion. This figure underscores the material danger these events pose to the regional economy and individual enterprise stability.

The Scope of Hurricane Threats

To build operational resilience, a company must first identify its specific vulnerabilities. For Texas industries, hurricane risks can be categorized into three primary areas:

- Physical Risks: Direct damage to facilities, equipment, and inventory caused by high-velocity winds, coastal storm surge, and widespread inland flooding.

- Operational Risks: Disruption to core business activities resulting from port closures, blocked transportation corridors (road and rail), and prolonged power outages that idle production.

- Financial Risks: Direct and indirect monetary losses, including costs from business interruption, lost revenue, and long-term expenses associated with recovery and rebuilding.

A critical first step in mitigating physical risk is conducting comprehensive building condition surveys. This analysis identifies structural weaknesses before a storm is forecast, enabling targeted capital improvements.

The following matrix summarizes the primary risks for Texas's core economic sectors, providing decision-makers with a high-level overview of their industry's key vulnerabilities.

Hurricane Risk Matrix for Key Texas Industries

| Industry Sector | Primary Physical Risk (e.g., Asset Damage) | Primary Operational Risk (e.g., Supply Chain Disruption) | Primary Financial Risk (e.g., Business Interruption Costs) |

|---|---|---|---|

| Energy & Petrochemical | Damage to refineries, storage tanks, and offshore platforms from wind and storm surge. | Port closures halting crude imports and product exports; widespread power grid failure. | Production losses, delayed shipments, and volatile commodity pricing. |

| Manufacturing | Flooding of production floors; damage to sensitive equipment and raw material inventory. | Inbound/outbound logistics halted by road/rail closures; workforce displacement. | Lost production days, order fulfillment penalties, and increased material costs. |

| Logistics & Transportation | Damage to port facilities, warehouses, and vehicle fleets. | Blocked transportation corridors (ports, highways, railways); gridlock across the network. | Lost shipping revenue, container demurrage fees, and asset repair expenses. |

| Agriculture | Crop destruction from wind and flooding; damage to farm buildings and equipment. | Inability to harvest or transport goods to market; loss of livestock. | Lost crop value, damaged infrastructure replacement, and long-term soil contamination. |

| Construction | Damage to active job sites, unsecured materials, and heavy equipment. | Project delays due to site access issues and material shortages. | Rework costs, schedule penalties, and increased material procurement expenses. |

This matrix illustrates the interconnected nature of these risks. Physical damage almost invariably triggers a domino effect across operations and finances, reinforcing the need for a holistic risk management framework.

A Strategic Imperative for Texas Leaders

Treating hurricane preparedness as a strategic imperative—rather than a compliance exercise—is what differentiates companies that recover quickly from those that do not. This requires a shift from a reactive posture to a proactive, data-driven approach.

By analyzing historical storm data and modeling potential impacts, a business can quantify its unique exposure. This type of data-driven assessment enables informed capital allocation, whether for reinforcing critical infrastructure or diversifying supply chain partners. Executives can gain insight into this process by exploring modern climate risk assessment tools.

This guide provides a framework for understanding these vulnerabilities before delving into a deeper, sector-specific analysis.

Disclaimer: The information provided in this article is for educational purposes only. ClimateRiskNow does not sell insurance or provide financial advice.

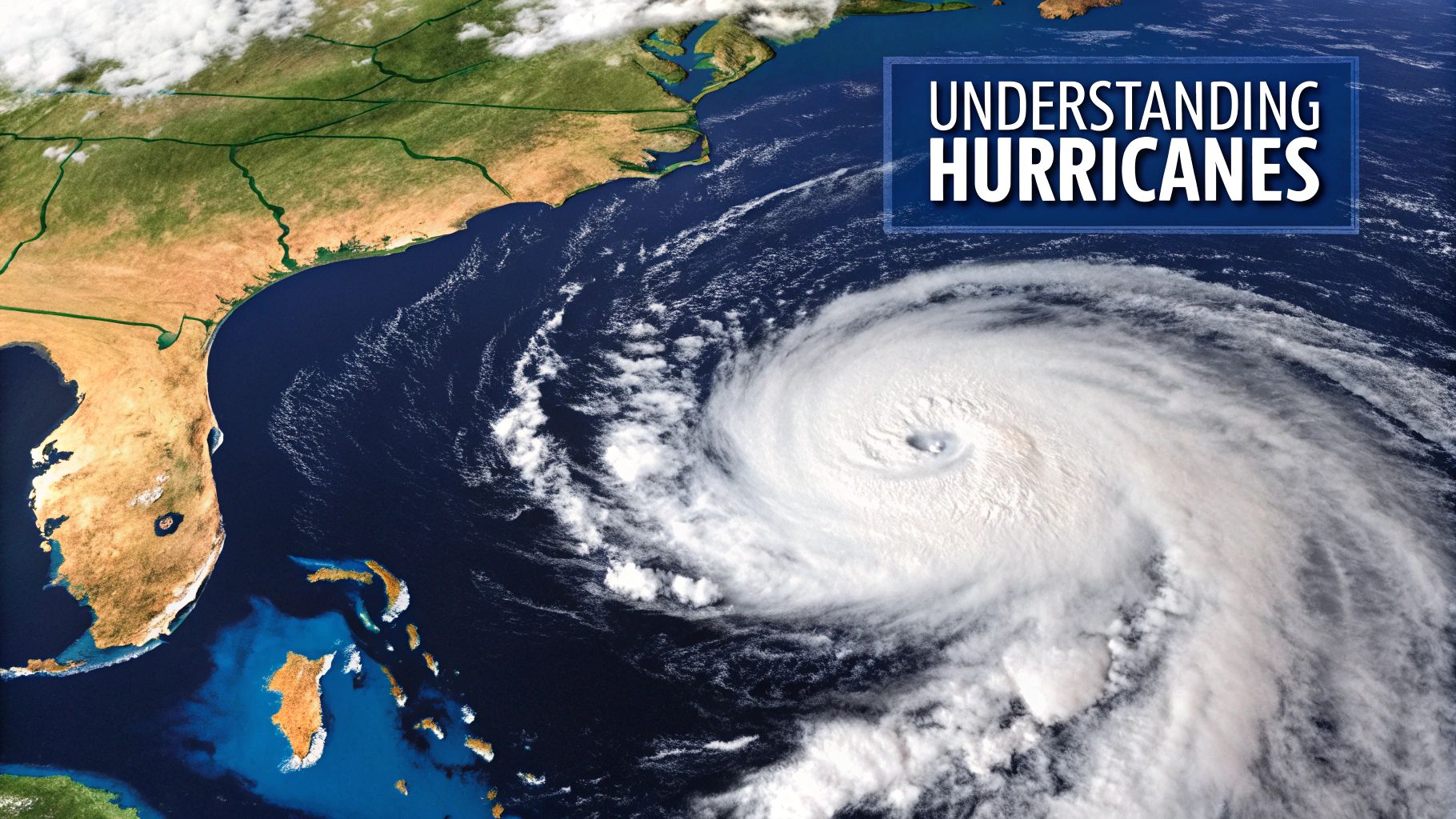

How a Hurricane Develops and Impacts Operations

To effectively manage operational risk from a hurricane, Texas business leaders must first understand the mechanics of the threat. A hurricane is not a random weather event but the product of a specific atmospheric process requiring precise conditions—namely, warm ocean water and moist, unstable air—to develop.

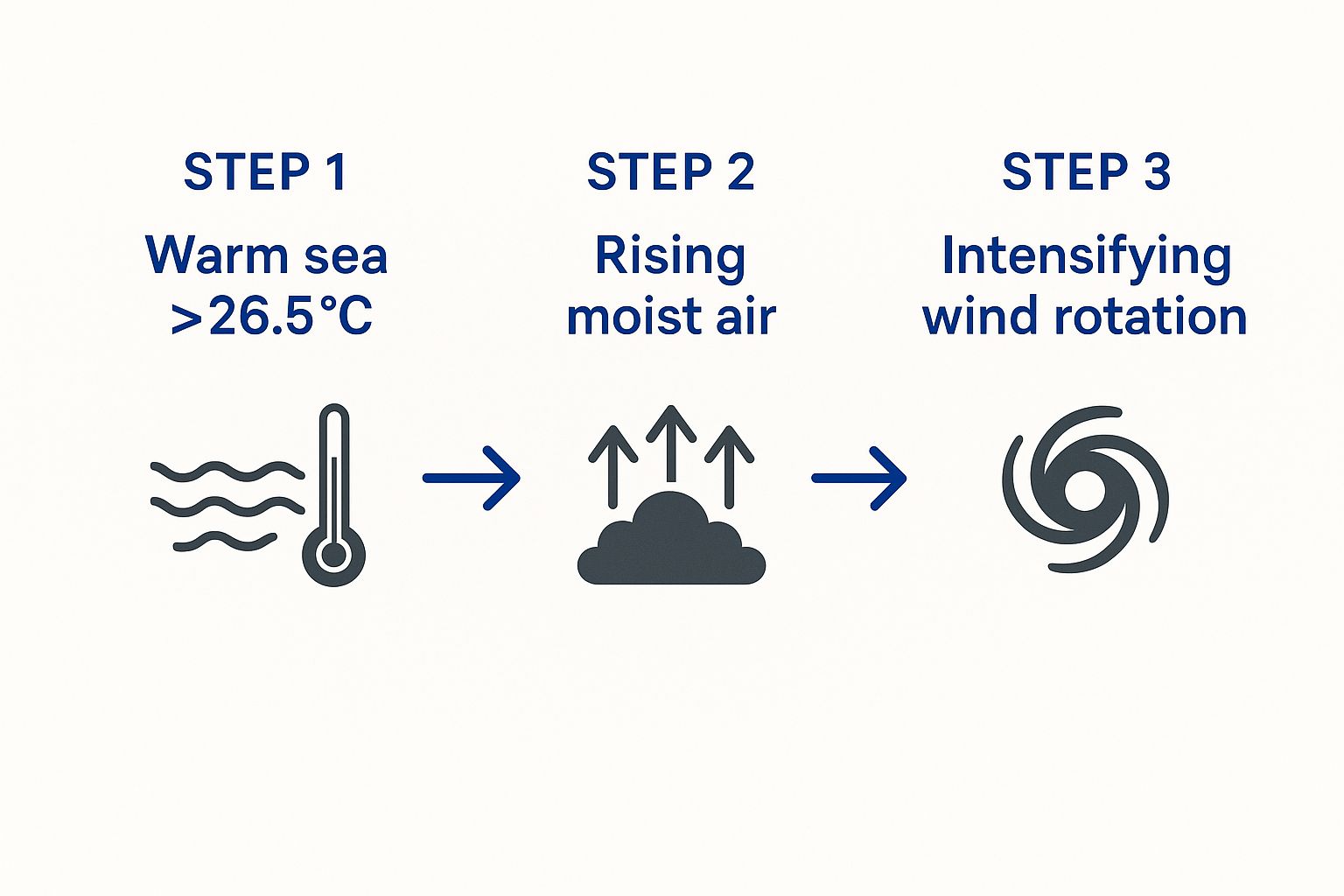

The process begins when ocean surface temperatures exceed 80°F (26.5°C). This fuels the creation of warm, moist air that rises, cools, and condenses, releasing a tremendous amount of latent heat. This energy warms the surrounding air, accelerating its rise and creating a low-pressure area that draws in more air, establishing a self-sustaining convective cycle.

This infographic breaks down the fundamental steps in this atmospheric engine, illustrating how warm water and rising air serve as the key inputs for storm formation.

As shown, the process escalates as wind rotation organizes, transforming a simple weather disturbance into a significant operational threat for Texas industries. For a more technical review of the atmospheric inputs, learn more about what conditions are needed for hurricanes to form in our detailed guide.

From Tropical Depression to Major Hurricane

The progression from a disorganized weather system to a major hurricane occurs in distinct stages, each with different implications for business operations.

- Tropical Depression: An organized system of clouds and thunderstorms with a defined circulation and sustained winds of 38 mph or less. At this stage, business action focuses on monitoring forecasts and reviewing preparedness plans.

- Tropical Storm: The system becomes more organized, with sustained winds between 39 and 73 mph. A storm is named at this point, signaling a clear threat. This is the trigger for initiating preliminary actions, such as securing loose equipment and confirming supply chain contingencies.

- Hurricane: A powerful cyclone with sustained winds of 74 mph or higher. The storm poses a significant risk to physical assets and operational continuity, requiring the execution of advanced preparedness protocols.

This classification system provides a valuable framework for decision-makers, translating meteorological forecasts into a tangible business timeline that enables a structured, phased response rather than a last-minute reaction.

The crucial takeaway for any Texas executive is that a hurricane's intensity directly correlates to the severity of its operational impact. Understanding its lifecycle is the first step toward building a truly resilient enterprise.

Translating Storm Metrics into Business Risk

The Saffir-Simpson Hurricane Wind Scale is the most recognized metric for hurricane intensity, but wind speed is only one component of operational risk. For Texas businesses, other storm characteristics are equally, if not more, critical.

A storm's forward speed, for example, is a key determinant of operational downtime. A slow-moving hurricane, such as Harvey in 2017, can linger over a region for days, causing catastrophic rainfall and prolonged inland flooding that shuts down transportation corridors and incapacitates facilities far from the coast.

Similarly, the size of the wind field dictates the geographic scope of the disruption. A large storm can impact multiple economic hubs simultaneously, causing a cascade of failures across statewide supply chains. A logistics company, for example, could see its Houston port operations halted by storm surge while its Dallas distribution center is paralyzed by blocked rail lines—all from the same event. It is these interconnected vulnerabilities that make hurricanes a complex risk management challenge.

A History of Hurricanes on the Gulf Coast

For Texas business leaders, analyzing the history of hurricanes is a critical component of strategic planning. These storms are a recurring operational reality, and historical data reveals a clear and concerning pattern. Past events transform abstract threats into tangible scenarios that demand a quantitative risk management plan.

The historical record is unambiguous. Since 1851, records show 1,745 tropical cyclones of at least tropical storm strength in the Atlantic basin. Notably, eight of the ten most active hurricane seasons since 1950 have occurred since the mid-1990s. Decision-makers can explore detailed Atlantic hurricane records to observe this trend.

The trend is not just toward more storms, but more powerful ones. The Accumulated Cyclone Energy (ACE) Index, a metric that accounts for both storm intensity and duration, shows a distinct upward trend over the past 30 years. For any Texas-based enterprise, this data indicates that past storms serve as a baseline for the more intense, disruptive events that must be anticipated now.

Landmark Storms and Their Lasting Business Impact

To fully appreciate the scale of this threat, it is instructive to examine specific storms that reshaped the region's economy. Hurricane Ike (2008) and Hurricane Harvey (2017) serve as powerful case studies in operational vulnerability.

Hurricane Ike delivered a severe lesson in the destructive power of storm surge. Its impact on the Galveston and Houston areas crippled the Houston Ship Channel—a vital artery for the nation's energy and petrochemical industries.

- Operational Shutdown: The surge inundated port facilities, destroyed critical infrastructure, and scattered shipping containers, resulting in a prolonged shutdown of one of the world's busiest ports.

- Cascading Failures: This single point of failure triggered a domino effect. Crude oil imports and refined product exports ceased, causing significant production losses for refineries and chemical plants throughout the region.

Ike demonstrated that businesses located miles inland are not immune to coastal devastation, highlighting the deep interconnectedness of the Texas economy.

Hurricane Harvey: A Paradigm Shift in Flood Risk

Nearly a decade later, Hurricane Harvey taught a different but equally devastating lesson. Harvey's primary threat was not wind speed but unprecedented rainfall that caused catastrophic flooding deep into Southeast Texas. The storm remained nearly stationary for days, depositing over 60 inches of rain in some areas and fundamentally altering the understanding of flood risk.

Harvey's impact on key sectors was immense:

- Manufacturing & Logistics: Widespread flooding shut down manufacturing plants, submerged warehouses, and rendered major highways like Interstate 10 impassable for weeks, paralyzing supply chains.

- Energy Sector: Numerous refineries executed emergency shutdowns due to flooding and power loss, disrupting a significant portion of the U.S. fuel supply.

Harvey’s legacy is a stark reminder that hurricane risk extends far beyond the immediate coastline. The sheer volume of water overwhelmed existing flood defenses, proving that historical floodplains are no longer a reliable guide for asset placement or operational planning.

The storm caused an estimated $125 billion in damages, tying Hurricane Katrina as the costliest tropical cyclone in U.S. history. For a deeper analysis of the operational failures and recovery strategies, review key lessons learned from Hurricane Harvey in our detailed report. These events are not just anecdotes; they are data points that underscore the urgent need for modern, data-driven strategies to protect Texas businesses.

Analyzing Hurricane Impacts on Key Texas Industries

For any business leader in Texas, a hurricane's impact is not uniform across all industries. A storm that floods a coastal refinery creates entirely different shockwaves for an inland manufacturing plant or a regional logistics hub. Understanding these sector-specific vulnerabilities is the foundational step toward building an effective risk management strategy.

The financial cost of these events is staggering. Hurricane Harvey (2017) and Hurricane Katrina (2005) remain the costliest tropical cyclones on record, each causing an estimated $125 billion in damages. This figure primarily accounts for direct physical damage to buildings and infrastructure, omitting the full economic fallout from months of business interruption and paralyzed supply chains. One can see the full financial scale of these storms to better grasp the stakes.

Hurricane Impact Analysis by Texas Industry

To properly assess risk, it must be broken down by sector. A hurricane's impact is determined by how its physical forces—wind and water—interact with the specific operational model of each industry. The table below details how a major storm can disrupt Texas's economic engines.

| Industry | Key Operational Vulnerability | Example Consequence | Potential Financial Impact |

|---|---|---|---|

| Energy & Petrochemical | Coastal infrastructure (refineries) | Forced shutdowns from storm surge flooding | Billions in lost production, national fuel price spikes |

| Manufacturing | Supply chain & utility dependence | Production halt due to inaccessible roads and power outages | Lost revenue, contract penalties, equipment recommissioning |

| Logistics & Transport | Port, rail, and highway integrity | Port of Houston closure, flooded distribution centers | Crippled shipping capacity, asset damage, delivery fines |

| Agriculture | Crop exposure & livestock safety | Widespread crop destruction from wind and flooding | Millions in lost yields and livestock, long-term soil damage |

| Construction | Job site & material security | Damaged projects, loss of unsecured materials, equipment damage | Project delays, rework costs, increased insurance premiums |

Each vulnerability represents a potential point of catastrophic failure. For Texas businesses, ignoring these specific risks is tantamount to accepting devastating financial and operational losses when the next major storm makes landfall.

Energy and Petrochemical Sector Vulnerabilities

The Texas Gulf Coast is the epicenter of America’s energy industry, placing it directly in the path of hurricane disruption. For oil, gas, and petrochemical companies, risks are heavily concentrated and can create a domino effect across the national economy. The primary threats are direct physical damage to coastal infrastructure from high-velocity winds and, more critically, storm surge.

Offshore platforms, refineries, and chemical plants are sited near the coast, making them highly vulnerable to flooding. A major surge can compel emergency shutdowns that may require weeks or months to safely reverse. Pipeline integrity is another major concern, as severe flooding can cause soil erosion that compromises these critical assets, leading to costly repairs and significant environmental risks.

Hurricane Harvey serves as a stark case study. The storm temporarily disabled approximately 25% of U.S. refining capacity, causing significant fuel price spikes nationwide.

Manufacturing and Industrial Production Impacts

For manufacturers, a hurricane's threat extends beyond physical damage to the plant. The primary danger often arises from the chain reaction of failures that ripple outward from the storm's impact zone.

- Supply Chain Disruption: A major hurricane can sever the logistical lifelines a plant depends on. Flooded highways, closed ports, and damaged rail lines can halt the flow of raw materials and finished products, grinding production to a halt even if the facility itself remains undamaged.

- Workforce Displacement: These storms cause widespread community disruption. If essential employees cannot report to work due to flooded homes or impassable roads, operations cannot resume.

- Utility Outages: Power and water services can be interrupted for weeks. This is particularly damaging for sensitive manufacturing equipment, often leading to extended downtime and costly recommissioning procedures.

The key takeaway for manufacturers is that plant resilience is directly linked to the resilience of the surrounding region. An effective hurricane plan must account for the failure of public infrastructure, not just the structural integrity of the facility.

Logistics and Transportation Gridlock

The logistics sector functions as the circulatory system of the Texas economy; a hurricane acts as a major blockage. The most immediate impact is port closures. When a facility like the Port of Houston shuts down due to obstructed channels or damaged equipment, the bottleneck forms instantly.

From there, gridlock spreads inland. Flooded highways and impassable rail lines create a logistical paralysis for trucking and freight. Warehouses and distribution centers, even those hundreds of miles from the coast, can become inaccessible or sustain their own flood damage, creating bottlenecks that impact national supply chains. Improving a company's ability to withstand these shocks is critical, which is why a plan for supply chain resilience against extreme weather is essential.

Financial damages arise from multiple sources: lost shipping revenue, asset repair costs, and penalties for missed delivery deadlines. For logistics operators, success is determined by the speed at which they can reroute freight and communicate delays—a deciding factor between weathering the storm and incurring a significant financial loss.

Implementing Data-Driven Risk Mitigation Strategies

Understanding the operational and financial threats posed by natural disasters like hurricanes is only the first step. The critical next phase is shifting from analysis to action. For Texas business leaders, this means adopting a structured, data-driven approach to replace outdated checklists with proactive, intelligent risk mitigation.

A modern framework for managing hurricane risk is not a static task but a continuous, three-phase cycle. This allows decision-makers to make informed choices to minimize downtime, protect assets, and secure financial stability—long before a storm forms in the Atlantic.

Phase 1: Pre-Season Assessment

The most effective hurricane preparations begin months before the official June 1st season start. This period should be used for a thorough, data-grounded assessment of a company’s specific vulnerabilities, moving beyond general awareness to quantify precise operational exposures.

Key activities in this phase include:

- Asset Exposure Analysis: Utilizing high-resolution storm surge and flood plain maps to pinpoint which facilities, warehouses, or critical infrastructure are most at risk. This enables targeted investments in physical reinforcements or operational redundancies.

- Supply Chain Vulnerability Mapping: Analyzing primary and secondary routes for key suppliers and distribution networks. Overlaying these routes with historical hurricane tracks can reveal hidden choke points and single points of failure that require mitigation.

- Contingency Planning: Developing detailed, data-informed contingency plans for rerouting logistics, shifting production, or activating backup power. These are not theoretical exercises but executable playbooks ready for immediate activation.

Historical data underscores the urgency of this preparation. The intensity of Atlantic hurricanes has increased significantly since the mid-1990s, a trend correlated with rising sea surface temperatures that fuel stronger storms. The 2020 season set a record with 30 named storms and 13 hurricanes, a stark indicator of escalating risk. Business leaders can explore further data on tropical cyclone activity to better understand these long-term shifts.

Phase 2: Pre-Landfall Activation

As a storm system develops and its track becomes clearer, strategy shifts from planning to activation. In the crucial 72 to 96 hours before potential landfall, real-time data is paramount. Predictive modeling and advanced analytics are essential for making correct operational decisions at the right time.

For example, a logistics company can use predictive storm path analytics to begin rerouting trucks days in advance, avoiding inevitable gridlock. A manufacturing firm can use precise wind-field forecasts to determine the optimal window for safely powering down sensitive equipment, preventing millions in potential damage. For a closer look at how analytics can drive these decisions, our guide on data analytics for insurance offers relevant insights into modeling potential impacts.

Phase 3: Post-Storm Recovery and Analysis

Once a storm has passed, the focus immediately shifts to rapid recovery and strategic analysis. The first priority is assessing damage and safely resuming operations by executing the recovery protocols established pre-season.

An effective post-storm response extends beyond repairs. It involves capturing real-world data on what protocols succeeded, what failed, and how the storm’s impact compared to pre-season models. This creates a powerful feedback loop for continuous improvement.

This post-event analysis is vital. It allows a company to refine its risk models, update contingency plans, and make more informed capital investments for the next season. By treating each hurricane as a learning opportunity, an organization becomes progressively more resilient, transforming a reactive crisis into a strategic advantage.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice.

Building a More Resilient Texas Enterprise

With hurricanes intensifying and becoming more frequent, the challenge for Texas business leaders is undeniable. These natural disasters have repeatedly demonstrated their capacity to cripple key sectors, from energy and petrochemicals to manufacturing and logistics. The financial and operational stakes are simply too high for a reactive approach.

Reacting after a storm has made landfall is no longer a viable strategy. The era of relying on seasonal checklists is over.

The new imperative is to shift from a defensive posture to a proactive one. This involves integrating hurricane preparedness into the core of long-term business strategy. This should be viewed not as a sunk cost, but as a critical investment in operational continuity, supply chain integrity, and ultimately, a competitive advantage in a region defined by extreme weather risk.

Embracing a Proactive, Data-Driven Approach

Mitigating the threat of the next storm requires a fundamental change in risk perception. It is time to move beyond historical anecdotes and outdated flood maps. A truly resilient enterprise is built on a data-driven foundation. This means quantifying specific vulnerabilities—from a facility’s exposure to storm surge to critical choke points in a supply chain—to enable smarter, targeted investments in mitigation.

To fortify operations against hurricane-specific disruptions, exploring comprehensive supply chain resilience strategies is an essential component of building a more robust and reliable operational framework.

Foresight is the new foundation of enterprise resilience. By integrating advanced climate risk analytics into core business strategy, leaders can move beyond reacting to disasters and begin actively shaping their company's ability to withstand them.

This journey begins by asking the right questions, supported by precise, asset-level data. How would a Category 4 storm impact primary distribution routes? What is the quantifiable financial exposure of coastal assets to a 15-foot storm surge?

Answering these questions is the first step toward building a Texas enterprise that is prepared to thrive, regardless of what the Gulf of Mexico produces.

Explore how the Sentinel Shield platform can deliver the asset-level risk intelligence your organization needs to turn vulnerability into a strategic advantage.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice.

Answering Your Key Questions

For business leaders in Texas, hurricane season raises critical operational questions. Obtaining data-driven answers is the foundation of a resilient business continuity plan.

How Far Out Should We Start Prepping for a Hurricane?

Effective preparation is a continuous, year-round process. The most resilient businesses integrate hurricane preparedness into their strategic planning, assessing facility and supply chain vulnerabilities long before the June 1st season start.

When a storm is forecast, the timeline accelerates. Your team should be on high alert 5-7 days prior to potential landfall. Critical decisions—such as securing physical assets, arranging alternate logistics, or activating remote work plans—must be finalized 48-72 hours in advance, based on the best available forecast data. Delaying beyond this window introduces unacceptable risk.

What is the Single Biggest Mistake Companies Make with Hurricane Risk?

The most common and damaging mistake is focusing exclusively on internal assets and facilities. A company can invest heavily in hardening a facility, but that investment is negated if it ignores the external dependencies that enable business operations.

What is the operational impact if the port is closed for two weeks? If access roads to your plant are impassable? If the power grid is down indefinitely? These indirect disruptions are what cripple operations. A business can sustain zero physical damage yet be completely paralyzed. A comprehensive risk plan must account for these cascading failures across the entire supply chain and local infrastructure.

Besides Property Damage, What Are the "Hidden Costs" of a Storm?

The cost of repairs is only the initial financial impact. The hidden costs are what truly threaten a company's long-term financial health and market position.

These are the financial impacts that persist long after the storm has passed:

- Lost Revenue: Every hour of operational downtime represents permanent revenue loss.

- Reputational Damage: Failure to deliver to customers erodes trust that is difficult to regain.

- Employee Displacement: A storm impacts your workforce. A scattered and stressed team cannot maintain productivity.

- Increased Future Costs: Following a major disaster, insurance premiums and the cost of capital in the affected region invariably rise.

Data-driven risk management is not just about protecting a building from wind and water. It is about protecting revenue, brand reputation, and human capital from the full spectrum of a hurricane's impact.

It's time to move from reacting to weather to proactively managing risk. Contact ClimateRiskNow to see how the Sentinel Shield platform can provide the asset-level intelligence you need to make smarter, more strategic decisions.