For key Texas industries like Energy, Manufacturing, and Logistics, cyber risk and insurance are not merely IT concerns—they are fundamental operational risks. A digital vulnerability can rapidly escalate into a physical shutdown, making a proactive risk management strategy a critical component of business continuity.

Disclaimer: The information provided in this article is for educational and informational purposes only. ClimateRiskNow does not sell insurance or financial products, and this content should not be interpreted as financial or insurance advice. Business leaders should consult with qualified professionals to assess their specific needs.

Translating Cyber Threats Into Operational Realities

To many executives, the language of cybersecurity—"phishing," "malware," "DDoS attacks"—can seem abstract. To make informed decisions, it is essential to translate these digital threats into tangible, operational impacts. A disruption to your digital infrastructure can paralyze physical operations, impacting production, logistics, and revenue. The first step in managing this exposure is understanding business vulnerability to hackers.

From Digital Breach To Physical Disruption

A ransomware attack is a direct assault on production capacity. For a manufacturing plant in the Dallas-Fort Worth area, this could mean an immediate halt to the assembly line, resulting in missed deadlines and significant revenue loss. Similarly, a third-party data breach affecting a Houston-based logistics provider can grind the entire supply chain to a halt. If shipping manifests and tracking systems go dark, trucks stop moving, and deliveries are delayed.

These scenarios illustrate a critical point: cyber risk is business risk. It demands the same level of strategic planning as operational safety or supply chain management. You can explore our guide on developing robust business risk management strategies to build a more resilient operational framework.

Why Texas Businesses Must Connect Digital and Operational Risk

Cyber threats have direct physical consequences for the industries that power the Texas economy. To help leadership teams grasp their specific vulnerabilities, it is useful to map common digital attacks to their direct operational outcomes.

The table below outlines these connections for key Texas sectors.

| Translating Cyber Threats into Operational Impacts for Texas Industries |

| :--- | :--- | :--- |

| Texas Industry | Common Cyber Threat Example | Potential Operational Impact |

| Energy & Petrochemical | Ransomware attack on SCADA systems controlling pipeline flow. | Immediate shutdown of pipeline operations, causing supply chain disruptions and significant revenue loss. |

| Manufacturing | Malware infecting the industrial control systems (ICS) of an assembly line. | Production halt, equipment damage from improper operation, and potential product quality issues. |

| Logistics & Transportation | Phishing attack compromises fleet management software. | Disruption of routing and dispatching, leading to delayed shipments, fuel waste, and contract penalties. |

| Agriculture | A breach of farm management software compromising irrigation or crop-dusting drone schedules. | Crop yield reduction, resource waste, and potential spoilage of perishable goods. |

| Construction | Data theft of proprietary blueprints and project bids from a compromised server. | Loss of competitive advantage, project delays, and potential liability for intellectual property theft. |

This table provides a clear picture: for any Texas business, a cyber incident is rarely contained to the digital realm—it quickly becomes a costly operational problem.

The Growing Need For a Financial Backstop

As digital threats become more sophisticated, organizations require financial mechanisms to mitigate the fallout. Cyber insurance has emerged as a tool to help businesses manage financial losses from a wide range of these threats, including data breaches and service interruptions.

The market for this coverage reflects its growing importance. Valued at USD 11.0 billion in 2024, it's projected to reach USD 32.3 billion by 2034. This growth signals that companies recognize the necessity of a financial recovery plan in addition to preventative security measures.

Understanding Cyber Insurance in Your Risk Strategy

Cybersecurity defenses are the first line of protection, designed to prevent an incident. Cyber insurance serves a different purpose: it is a risk transfer mechanism designed to provide financial resources for recovery after an incident occurs. It is not a replacement for strong security controls.

A common misconception can lead to significant vulnerability. One recent study found that while 87% of small business leaders are concerned about cyber attacks, 64% believe their business is too small to be a target. Attackers often seek the path of least resistance, making under-prepared companies prime targets. A cyber insurance policy can serve as a financial safety net when preventative measures are breached.

The Role of Insurance in Financial Recovery

When a cyber attack occurs, the financial damage can be immediate and substantial. A comprehensive cyber risk and insurance strategy anticipates these costs. A cyber policy is designed to cover direct and indirect financial losses that are typically excluded from general liability insurance.

Here is where cyber insurance can provide critical financial support:

- Business Interruption Costs: For a Houston manufacturing plant or a Laredo logistics hub, downtime directly impacts revenue. Cyber insurance can cover lost income and ongoing operational expenses while systems are being restored.

- Data Recovery and Restoration: Rebuilding corrupted databases and restoring essential software requires specialized expertise and significant capital—costs that are a core component of most cyber policies.

- Regulatory Fines and Legal Fees: A data breach involving customer or employee data can lead to regulatory penalties. A policy can often cover legal defense costs, settlements, and fines under regulations such as the Texas Identity Theft Enforcement and Protection Act.

- Incident Response Expenses: This covers immediate needs, such as hiring forensic investigators, engaging public relations firms to manage reputational damage, and providing credit monitoring for affected individuals.

A Strategic Component of Risk Management

Viewing cyber insurance solely as a reactive tool is a limited perspective. The underwriting process itself can enhance a company's security posture. Insurers require specific controls, such as multi-factor authentication and employee training, compelling businesses to strengthen their defenses. Using dedicated tools like the Best Risk Management Software Platforms can help streamline the process of identifying risks and meeting insurer requirements.

A well-structured policy often provides access to a pre-vetted team of experts. In the event of an attack, the policy can connect a business with legal, forensic, and PR specialists, saving critical time and limiting overall damage.

Ultimately, a sound cyber insurance policy can contribute to financial stability and operational resilience. It is a key component of a modern risk management plan. For a deeper analysis of policy structures, refer to our complete cyber insurance report.

Navigating the Modern Cyber Insurance Market

The market for cyber risk and insurance is dynamic, influenced by evolving threats and the industry's response. For Texas businesses in sectors like Energy, Manufacturing, and Construction, obtaining coverage is a strategic negotiation where a company's security posture is paramount. Insurers are conducting deeper analyses of cybersecurity controls as a direct result of the increasing frequency and severity of cyberattacks.

The Shift to a Harder Insurance Market

A "hard" insurance market is characterized by stricter underwriting, higher premiums, and more limited coverage. The trend for cyber insurance is clear: carriers require evidence of active risk management. Just as an insurer would require proof of flood barriers for a coastal petrochemical plant, they now demand evidence of digital defenses.

Insurers aim to partner with businesses that actively mitigate their own risk. A strong cybersecurity framework signals that a company is a responsible partner, not merely a potential liability. This approach is key to obtaining favorable terms.

This shift means Texas businesses in Construction, Agriculture, and Logistics must demonstrate their digital resilience. A documented incident response plan, regular employee training, and robust data backups are now standard requirements.

Underwriting Gets More Granular

The days of simple questionnaires are over. Today's underwriting process is data-driven and requires hard evidence of security controls. This reflects a more mature approach to assessing digital risk. The digitalisation in the insurance industry has accelerated, allowing carriers to analyze risk with greater precision and price policies more accurately.

To prepare for this detailed review, businesses need clear documentation for key security measures:

- Multi-Factor Authentication (MFA): Considered non-negotiable for protecting remote access and critical accounts.

- Endpoint Detection and Response (EDR): Advanced tools that monitor devices for suspicious activity are a significant factor in underwriting.

- Backup and Recovery Systems: Businesses must demonstrate that backups are segregated from the primary network, tested regularly, and capable of timely restoration.

- Employee Security Training: A documented, ongoing training program demonstrates a commitment to building a culture of security awareness.

Market Growth and the Coverage Gap

This rigorous environment has not slowed market growth. The global cyber insurance market was approximately USD 15.3 billion in 2024, with North America accounting for USD 10.6 billion in premiums. Projections show the market more than doubling by 2030, growing at over 10% annually. You can discover more insights about these cyber insurance trends on munichre.com.

However, this growth highlights a significant issue: a large portion of these premiums originate from large corporations, leaving a protection gap for small and medium-sized businesses, which are often the most vulnerable and least able to absorb the financial impact of an attack.

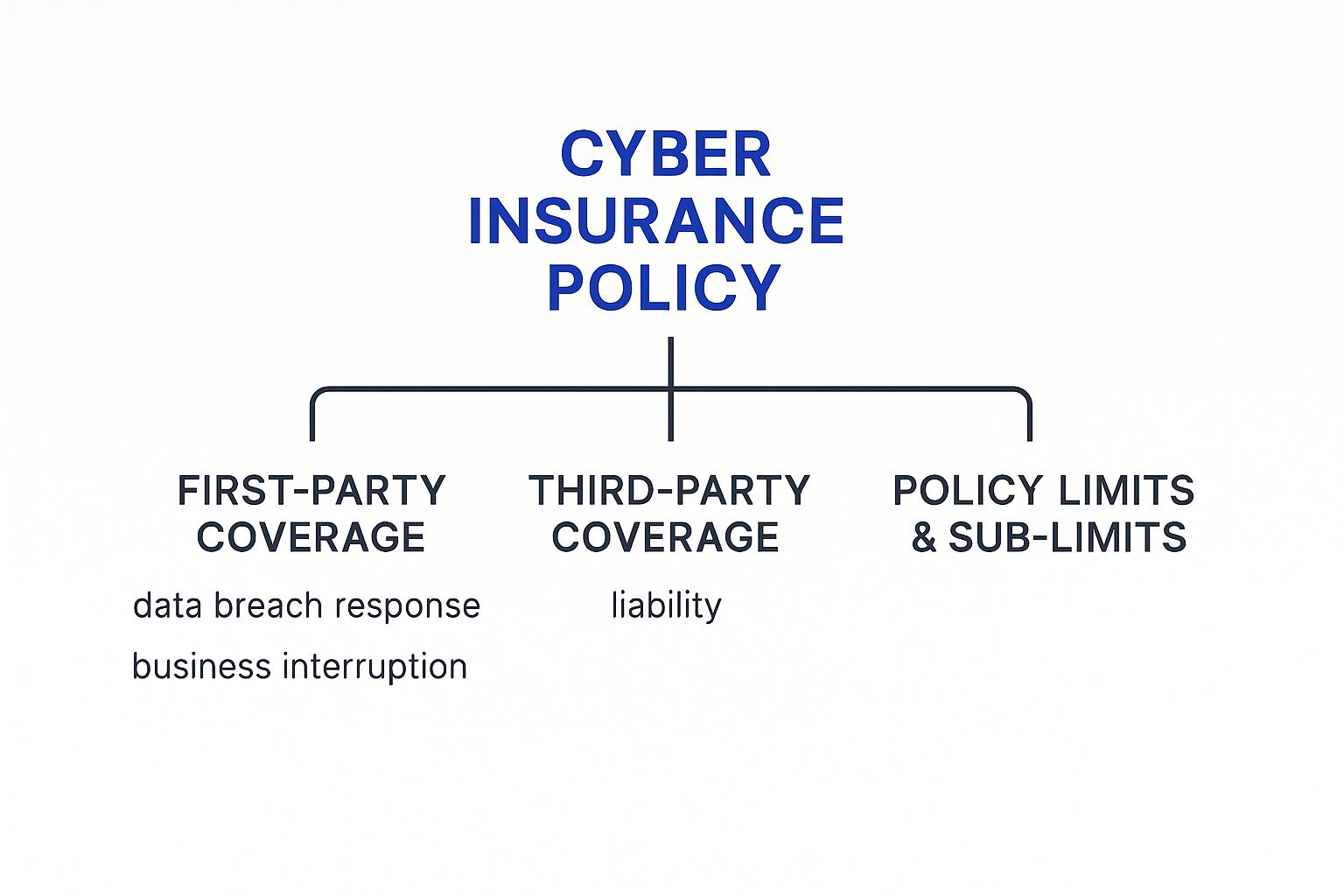

Decoding Your Cyber Insurance Policy

A cyber insurance policy can appear complex, but its core structure is straightforward. The policy is designed to protect a business from the financial consequences of a cyberattack in two primary ways: by covering the company's own direct losses and by shielding it from liability when others are harmed.

First-Party Coverage: Your Direct Costs

First-party coverage addresses your direct financial losses following a cyber incident. For a manufacturing firm near Houston, a ransomware attack could halt production for a week; the resulting lost income is a first-party cost. For an agricultural co-op in the Panhandle, the expense of hiring forensic experts to investigate a breach is a direct cost covered by this part of the policy.

Key first-party coverages typically include:

- Incident Response Costs: Covers immediate expenses for forensic investigators, legal teams, and PR firms.

- Data Restoration: Pays for the technical expertise needed to recover or rebuild lost or corrupted digital assets.

- Business Interruption: Reimburses for lost profits and covers fixed operating costs during operational downtime caused by a cyberattack.

- Cyber Extortion: Addresses ransomware by covering payments and the cost of consultants specializing in negotiations.

As shown, first-party and third-party protections are the two main pillars of a cyber policy, each contributing to business stability.

Third-Party Coverage: Your Liabilities to Others

Third-party coverage protects your business when a cyber incident on your systems causes harm to customers, partners, or other external parties. It is a liability shield. For example, if a logistics company in Laredo suffers a breach that exposes sensitive client shipping data, and those clients sue, third-party coverage would address the legal defense costs and any potential settlements.

The financial impact of a cyber incident often extends beyond your organization. Downstream consequences can be as damaging as the initial breach itself.

This liability coverage typically includes:

- Privacy Liability: Covers legal obligations when customer or employee data is compromised, including costs for credit monitoring and regulatory fines.

- Security Liability: Protects you if a security failure on your network damages another party's systems, such as transmitting a virus to a client.

- Media Liability: Addresses claims such as copyright infringement or libel related to your company’s digital content.

To clarify the distinction:

First-Party vs. Third-Party Cyber Insurance Coverages

| Coverage Category | What It Covers | Example for a Texas Business |

|---|---|---|

| First-Party | Your direct financial losses and recovery costs. | A Dallas-based construction company pays an IT firm to restore its project management systems after a malware attack. |

| Third-Party | Your legal liability for damages caused to others. | The same construction company is sued by a client because the breach delayed a major project, causing financial losses for the client. |

Understanding both sides of cyber risk and insurance is essential for Texas business leaders. Insurers increasingly use sophisticated analytics for insurers to price these risks, and a knowledgeable approach allows you to ensure your policy aligns with your business needs.

Evaluating a Cyber Insurance Policy

Selecting a cyber insurance policy requires a detailed review of its terms and conditions. For a Texas business leader, understanding the fine print is what transforms a policy from a document into a reliable financial backstop. Key terms like limits, deductibles, and exclusions determine the extent of financial responsibility your company will bear after an incident. The objective is to ensure the policy's terms align with your company’s specific risks and incident response capabilities.

Key Financial Terms to Scrutinize

A few financial components demand close attention, as they define the insurer's responsibility and your own.

- Policy Limits: The maximum amount the insurer will pay for all claims during the policy period.

- Sub-limits: Insurers often place smaller caps on specific types of losses. For example, a $2 million policy might have a $250,000 sub-limit for ransomware payments—a crucial detail to identify upfront.

- Deductibles/Retentions: The amount your company must pay out-of-pocket before insurance coverage begins. A higher deductible may lower the premium but increases the immediate financial burden during an incident.

Uncovering Critical Policy Exclusions

What a policy does not cover is as important as what it does. Exclusions are specific scenarios the insurer will not pay for. For instance, a construction company might find its policy excludes losses from a breach caused by a subcontractor’s weak security. An energy firm could discover that physical infrastructure damage resulting from a cyberattack is not covered, leaving a significant operational and financial gap.

A thorough policy evaluation involves asking "what-if" questions based on your most probable risk scenarios. Aligning these scenarios with the policy's language is the only way to confirm you have the right protection.

Reviewing exclusions with legal and operational teams is an essential part of due diligence in managing your company’s cyber risk and insurance strategy.

Market Conditions and Policy Strength

The current cyber insurance market is rewarding businesses with strong security controls. As of early 2025, cyber insurance premiums dropped by 7%, creating a more favorable environment for buyers. Despite a 22% jump in reported incidents in 2024, the average claim payout fell by 77%, indicating that effective cybersecurity measures are mitigating the financial impact of attacks.

This trend underscores a clear message: insurers are offering better terms to businesses that invest in their own defenses. A proactive security posture is now directly linked to better, more affordable coverage. Our guide to current cyber insurance trends offers more context for navigating this landscape.

Getting Insurable: How Strong Cybersecurity Makes All the Difference

The most effective way to manage your cyber risk and insurance costs is by integrating strong cybersecurity into your daily operations. Insurers are increasingly unwilling to partner with businesses that do not demonstrate a serious commitment to their own defense.

For Texas businesses in sectors like Agriculture and Manufacturing, cybersecurity controls are strategic investments that make them harder targets for attackers and more attractive partners for insurers.

The New "Table Stakes" for Coverage

Insurers now have a list of non-negotiable security measures. Lacking them may result in denial of coverage or prohibitively high premiums. These are the baseline requirements.

- Multi-Factor Authentication (MFA): This is arguably the single most important control. MFA requires a second form of verification beyond a password, effectively blocking attackers who use stolen credentials.

- Airtight Backup and Recovery Systems: In a ransomware attack, reliable backups are critical. They must be tested regularly, isolated from the main network (air-gapped), and proven to be restorable within a reasonable timeframe.

- Consistent Employee Training: An ongoing security awareness program that teaches employees to identify phishing emails and handle data securely demonstrates a culture of security.

These measures should not be viewed as mere checkboxes on an insurance application. They are foundational to a resilient business strategy that protects revenue, reputation, and operational continuity.

The Essential Security Checklist for Texas Industries

To translate these concepts into action, executives in Logistics, Construction, and Energy can use this checklist to assess their current posture.

- Have a Documented Incident Response (IR) Plan: A written plan that assigns roles, dictates communication protocols, and outlines technical steps to contain a threat is essential.

- Use Endpoint Detection and Response (EDR): EDR tools provide advanced threat monitoring on all devices, enabling you to detect and stop malicious activity before it spreads.

- Run Regular Vulnerability Scans and Patch Everything: A formal process to identify and remediate security weaknesses in software closes potential entry points for attackers.

Strengthening your cybersecurity posture is the most direct path to a better relationship with the cyber risk and insurance market. It shifts the conversation from one about potential liability to one about proven resilience.

Common Questions About Cyber Risk

Texas business leaders often have similar practical questions regarding cyber risk and insurance. Here are answers to some of the most common inquiries.

Does My General Liability Policy Cover a Cyberattack?

Almost always, the answer is no. Most general liability policies are designed for physical risks and now contain specific exclusions for cyber-related incidents. A dedicated cyber insurance policy is necessary to address the unique financial impacts of data breaches, ransomware, and digital business interruption.

How Much Does Cyber Insurance Actually Cost for a Texas Business?

There is no single answer. The cost depends on your industry, annual revenue, the type of data you handle, and, most importantly, your existing cybersecurity measures. A manufacturing firm in Fort Worth with robust security protocols presents a different risk profile than a logistics company in Laredo with minimal controls.

What’s the Single Most Important Security Measure I Need to Get Insured?

If one measure is non-negotiable for insurers, it is Multi-Factor Authentication (MFA). Stolen credentials are a primary vector for attackers, and MFA provides a powerful additional layer of security. Implementing MFA across all critical systems is one of the most effective steps a business can take to improve its security posture and insurability.

At ClimateRiskNow, we provide the critical weather and climate risk intelligence Texas businesses need to build resilient operations. Our Sentinel Shield assessments deliver actionable data on your facility's exposure to events like hurricanes, freezes, and floods, empowering you to make strategic decisions that protect your assets and ensure continuity.