A deep dive into the car manufacturing industry reveals a sector in perpetual motion, constantly reshaped by new technology, intense supply chain pressures, and ever-shifting consumer demands. For business leaders in Texas, particularly within manufacturing and logistics, a firm grasp on this global landscape is the first step toward spotting opportunities and mitigating major operational risks.

This dynamic industry isn't just about building cars anymore; it’s about navigating a complex ecosystem of economic forces, relentless innovation, and increasing climate-related threats.

The Global Automotive Manufacturing Landscape

The automotive sector is a powerhouse of global commerce, defined by its massive scale and constant evolution. To understand its current state, decision-makers must look beyond individual brands and focus on the core numbers defining production, sales, and strategy. This high-level view provides the essential context for making informed decisions, whether your operations are based in Houston or stretch across continents.

After significant disruptions, the global car manufacturing industry has shown impressive resilience. It has rebounded strongly, hitting a production volume of nearly 92.5 million vehicles worldwide. This recovery surpasses pre-pandemic levels, signaling solid underlying demand despite economic headwinds. You can explore more data on the global automotive market at Statista.com.

To put the sheer scale of this industry into perspective, here are the key figures in one place.

Key Global Automotive Industry Statistics at a Glance

This table summarizes the core metrics defining the current state of the global car manufacturing industry, providing a quick reference for key production and market data.

| Metric | Figure | Context/Note |

|---|---|---|

| Global Production Volume | ~92.5 million units | Represents a strong post-pandemic rebound and continued growth. |

| Top Producing Country | China | Consistently leads global production by a significant margin. |

| Global Market Size | ~$3 trillion | Reflects total revenue from vehicle sales, parts, and services. |

| Electric Vehicle (EV) Share | ~18% of new sales | EV adoption is accelerating, driven by regulations and consumer interest. |

| Top 3 Automakers (by revenue) | Volkswagen, Toyota, Stellantis | These giants dominate the market, but competition is fierce. |

These numbers paint a clear picture: this is a colossal industry facing a period of fundamental change, particularly with the unstoppable rise of EVs.

Key Economic Drivers and Market Health

Understanding what makes this sector tick is critical for Texas businesses. For instance, consumer demand is incredibly sensitive to economic conditions. Factors like interest rates and general financial confidence can have a huge impact. A small economic shift can send ripples through the entire supply chain, affecting everything from raw material orders from petrochemical plants along the Gulf Coast to how many cars leave dealership lots in Dallas.

And it’s not just the economy. Technology is now the primary force driving change. The industry-wide pivot to electric vehicles (EVs) and autonomous driving is massive, demanding enormous capital investment and a complete overhaul of traditional manufacturing processes.

Disclaimer: ClimateRiskNow does not sell insurance or provide financial advice. The information presented in this car manufacturing industry analysis is for educational purposes only, designed to help business decision-makers understand and prepare for operational risks.

The Role of Data in Assessing Risk

As the industry gets more complex, its vulnerabilities grow alongside it. Risks are coming from all directions, from supply chain bottlenecks in Asia to the real-world impact of extreme weather on a production facility. For a Texas executive, this could mean assessing how a hurricane in the Gulf could shut down a key supplier or how a sudden freeze could cripple logistics. Proactive leadership demands a data-driven approach to spot and neutralize these threats before they become expensive disasters.

For executives in manufacturing, logistics, and related fields, using data effectively is the key to building resilience. This means digging deep into:

- Supply Chain Dependencies: Where are your single points of failure? It’s crucial to identify them and diversify suppliers to reduce vulnerability.

- Production Bottlenecks: Pinpointing potential chokepoints in the manufacturing process that could bring everything to a grinding halt.

- External Threats: Analyzing how climate change and geopolitical instability can impact your facilities and shipping routes, from the Port of Houston to inland distribution centers.

Trying to manage all these variables without the right tools is like flying blind. Business leaders can explore various climate risk assessment tools to get a much clearer, data-backed picture of how potential weather-related events could impact their specific operations.

Deconstructing The Modern Automotive Supply Chain

A modern vehicle is a masterpiece of coordination. Look at any car, and you’re seeing a collection of over 30,000 individual parts from hundreds of suppliers scattered across the globe. This intricate network is the automotive supply chain, a complex system that turns raw materials like steel, aluminum, and petrochemical-derived plastics into finished cars. For any Texas-based business in logistics or manufacturing, understanding this chain is non-negotiable for spotting and mitigating operational risks.

The system is built on a tiered structure. At the top are the Original Equipment Manufacturers (OEMs)—household names like Ford, Toyota, or General Motors. Everything flows up to them, starting from a base of direct suppliers.

This hierarchy is how the industry manages its incredible complexity. But it also bakes in layers of interdependency, making the entire chain vulnerable when one link breaks.

Understanding The Supplier Tiers

The system is organized into distinct levels, each with a specific job.

- Tier 1 Suppliers: These companies are the direct partners of the OEMs. They design and build major components like engines, transmissions, seating systems, and advanced electronics, delivering these complex modules straight to the assembly line.

- Tier 2 Suppliers: These firms supply parts and materials to Tier 1 companies. A Tier 2 supplier might make the electric motors that go into a power-seat system or the specialized plastics—often sourced from Texas's petrochemical sector—that form a dashboard.

- Tier 3 Suppliers: This is where it all begins. Tier 3 suppliers process the raw materials—steel, aluminum, plastics, and resins—that Tier 2 manufacturers will turn into specific parts.

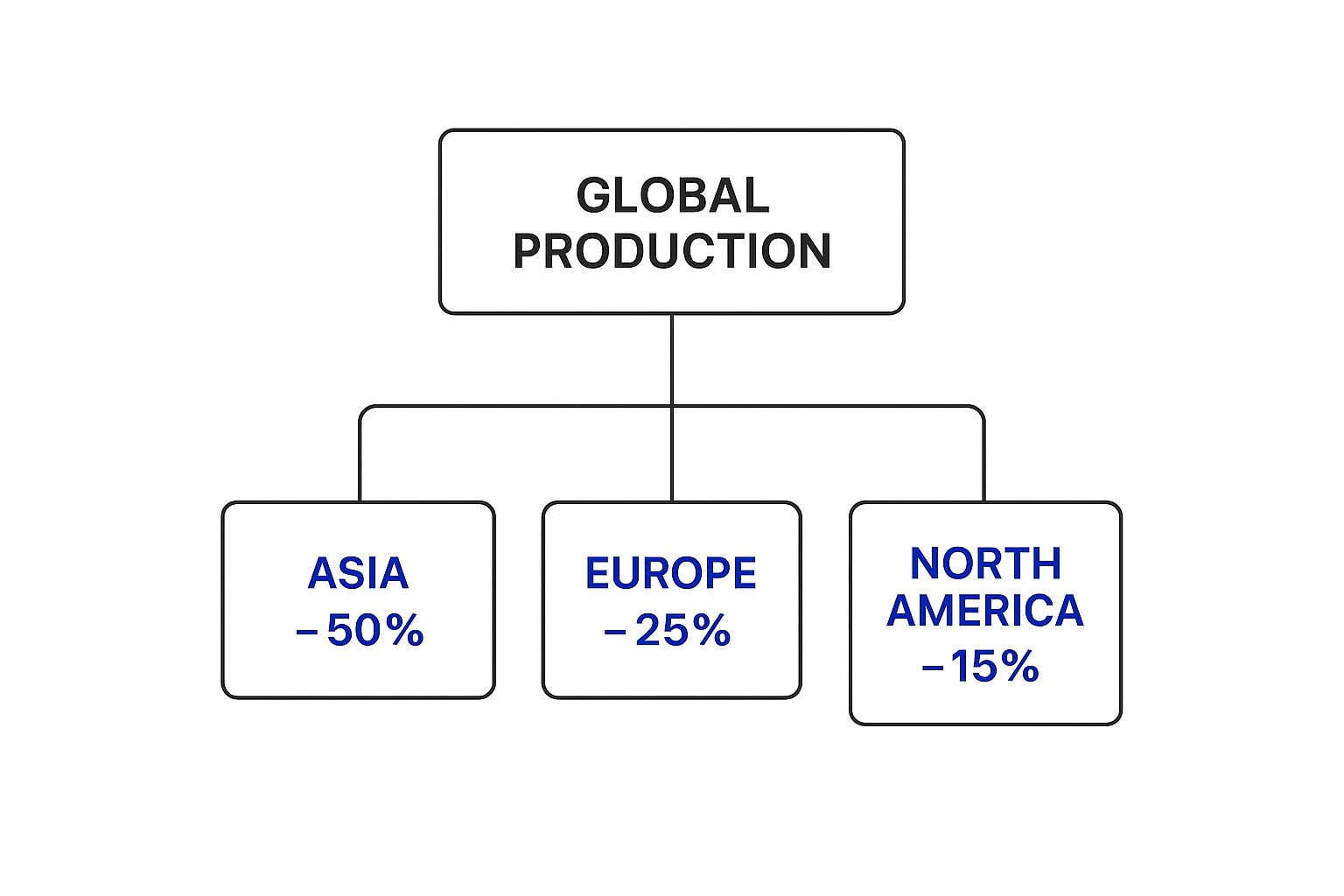

This infographic drives home how global production is, which in turn shapes the complexity of these supply chains.

The data speaks for itself. With 50% of production concentrated in Asia, these supply chains are inherently global. That means they are wide open to disruptions happening thousands of miles from home.

The Fragility Of Just-In-Time Manufacturing

For decades, the auto industry has relied on the Just-in-Time (JIT) manufacturing model. It’s a lean approach designed to cut warehousing costs by having parts arrive at the assembly plant exactly when needed. In a stable world, it’s incredibly efficient. But JIT also creates massive vulnerabilities.

A single disruption can halt everything. A hurricane delaying a container ship bound for the Port of Houston, a factory shutdown overseas, or a regional conflict can suddenly stop an assembly line in Arlington.

The recent global semiconductor shortage was a perfect, painful example. A spike in demand for consumer electronics, combined with factory shutdowns, created a massive chip deficit. This Tier 2 disruption shot up the chain, forcing OEMs to idle plants and slash production goals, leading to billions in lost revenue.

This highlights a critical lesson for any manufacturing or logistics operation: efficiency at the cost of resilience is a dangerous trade-off. A single point of failure thousands of miles away can directly impact operations in Texas.

For companies in Texas, this global web has direct local consequences. A hurricane in the Gulf could disrupt petrochemical supplies (Tier 3), which then hits plastic component manufacturers (Tier 2) across the country. Ultimately, that can halt a vehicle assembly line (OEM) waiting for those specific plastic parts.

Building resilience demands a proactive strategy. Improving supply chain visibility is paramount. Modern logistics operations are leaning more on data-driven solutions to track assets and manage fleets. For a real-world look at how data solutions are being used in fleet management, the Fleetio Case Study offers valuable insights. By understanding these connections and embracing new tools, businesses can better prepare for the costly delays that ripple through this complex global network.

Navigating Regional Market Dynamics

The global automotive market isn’t a single, uniform entity. It’s a collection of distinct ecosystems, each with its own economic pulse, consumer tastes, and regulatory pressures. A winning strategy in one region can miss the mark in another.

For business leaders in Texas, a meaningful car manufacturing industry analysis must dig into these regional differences. They dictate everything from demand forecasts and production targets to managing the risks of international trade.

A slowdown in European consumer spending or a new government policy in Asia has a tangible impact on manufacturing schedules and supply chains in North America. These markets are all connected, but the real story is in their individual performance.

The latest numbers show how different these paths can be. While global new vehicle registrations climbed 5% overall to 37.4 million units, that growth was uneven. China’s market surged by an incredible 12%, thanks largely to government incentives. North America saw more modest 2.5% growth, while Europe actually shrank by 2.4%. The latest global auto industry report breaks down the complete economic picture.

China: A Market Driven by Policy

China is the undisputed heavyweight in both car production and sales. But its market is heavily shaped by government intervention. Aggressive mandates and subsidies for electric vehicles (EVs) have supercharged domestic sales and turned Chinese manufacturers into global EV powerhouses.

For a Texas-based company, this creates a complex situation. China is a massive customer for high-end components and raw materials, including petrochemical products. At the same time, the meteoric rise of its domestic brands creates intense competition, forcing others to rethink their technology and pricing.

North America: Balancing Legacy and Transition

The North American market, including Texas, is a study in contrasts. Consumer preference has long skewed toward large trucks and SUVs. But a steady, undeniable shift toward EVs is now underway, pushed by federal and state incentives and tightening emissions rules.

This transition isn't simple. Manufacturers are balancing production of popular gas-powered models with ramping up brand-new EV assembly lines. It’s a massive operational challenge that strains supply chains and demands incredibly flexible factories. For logistics and manufacturing firms in Texas, it means planning for two different supply streams—one for traditional engines and another for batteries and electric motors.

Disclaimer: ClimateRiskNow does not sell insurance or provide financial advice. The information provided is for educational purposes only, intended to help business leaders assess and prepare for operational risks without recommending specific financial products.

Europe: Navigating Regulation and Economic Headwinds

Europe has one of the most regulated automotive markets on the planet. Extremely strict CO2 emissions targets are forcing a rapid phase-out of traditional gas and diesel cars. This regulatory hammer is the main reason EV adoption is accelerating so quickly across the continent.

However, the region has been battling serious economic headwinds, from volatile energy prices to high inflation, which has dampened consumer spending. This mix of intense regulatory pressure and a soft economy makes Europe a tricky market.

On top of that, extreme weather events like heatwaves and floods are hitting European manufacturing hubs more frequently, causing production delays that send shockwaves through global supply chains. Understanding this link between weather patterns and operational stability is no longer optional. We explore this topic in our analysis of climate change and natural disasters. These regional challenges highlight why a globally aware, locally focused risk strategy is essential.

Mapping the Competitive Landscape

The car manufacturing industry has become a high-stakes arena, pitting global giants against nimble newcomers in a battle for market dominance. A proper car manufacturing industry analysis must look past familiar logos to see the strategic chessboard these companies are playing on. The central fight right now is the clash between legacy automakers and a new wave of electric vehicle (EV) specialists.

This isn't just about who sells the most cars. It’s about who is best positioned to own the future. Legacy players like Toyota and Volkswagen Group bring decades of production mastery and vast global footprints. Their strength is in their sheer scale, brand loyalty, and deeply entrenched supply chains.

But these titans are being challenged head-on by EV-centric disruptors rewriting the rules of the game. These new companies compete on different terms, focusing on software, battery technology, and a direct-to-consumer model that sidesteps the traditional dealership network.

Legacy Giants Versus EV Disruptors

The competitive dynamic here is fascinating. Legacy automakers are attempting a difficult pivot, pouring billions into retooling factories and developing new EV platforms while still producing the profitable gasoline-powered vehicles that fund the transition. Their challenge is making this massive change without losing their current customer base or falling behind on innovation.

EV specialists, on the other hand, started with a clean slate. They aren't burdened by pension obligations or outdated manufacturing plants. This has allowed them to attract top tech talent and build brands synonymous with the future of driving. Their main hurdles are different: scaling production to meet demand, achieving consistent profitability, and building out reliable service networks.

The core of this competition is a race to master two very different skill sets: the industrial might of traditional manufacturing and the fast-paced, software-driven world of modern technology. The winners will be those who can successfully fuse both.

Strategic Pillars of Competition

Companies are competing across several key fronts, and each is critical for grabbing market share. Understanding these pillars helps clarify who is winning and why.

- Technological Innovation: This is no longer just about horsepower. Now, it’s about battery range, charging speed, autonomous driving features, and in-car connectivity. Companies leading in R&D are setting the pace for the whole industry.

- Production Efficiency: The ability to build high-quality vehicles at scale—and at a competitive cost—is still fundamental. A mastery of lean manufacturing and automation is a massive advantage, especially as everyone works to make EVs more affordable. A huge piece of this is quality assurance, since a single major recall can destroy a brand’s reputation. To learn more, check out our guide on the importance of manufacturing quality assurance.

- Brand Loyalty and Marketing: A powerful brand is a formidable asset. Automakers spend fortunes creating an emotional connection with customers, building loyalty that can last for decades. How a brand is perceived—as reliable, innovative, or sustainable—directly impacts purchasing decisions.

- Market Penetration: Gaining a solid foothold in high-growth regions, particularly in Asia, is non-negotiable for long-term success. This means navigating complex local regulations, adapting products for regional tastes, and building resilient local supply chains. The rise of Chinese EV manufacturers is a perfect example of how dominating a home market can reshape global competitive strategies.

Key Trends Shaping the Future of Automotive

The automotive industry is in the middle of its biggest shake-up in a century. A perfect storm of new technology and changing customer demands is forcing a complete rethink of what a car is and how it gets built. For business leaders, this is a period of both massive opportunity and serious operational risk.

A clear-eyed car manufacturing industry analysis must look beyond this quarter's sales numbers to the forces defining the next decade. These aren't far-off ideas; they are actively reshaping supply chains, factory floors, and entire business models right now.

The Inevitable Electric Vehicle Transition

The move to electric vehicles (EVs) is the most obvious trend, shifting from a niche to a mainstream reality. While overall global car sales are only expected to inch up by 1.6%, the real story is in electrification.

Even with a recent dip in the growth rate, EVs are on track to grab 45% of the global market by 2030. This isn't just about swapping a gas engine for a battery. It's a complete overhaul of the manufacturing ecosystem, presenting huge operational hurdles for businesses everywhere.

- Battery Production and Sourcing: The battery supply chain is the new global battleground, with immense pressure to secure critical raw materials like lithium and cobalt.

- Charging Infrastructure: Widespread EV adoption hinges on a reliable public charging network, a massive undertaking requiring public and private sector cooperation.

- Grid Capacity: A large fleet of EVs will put new strains on electrical grids, a major factor for utility operators and energy producers in Texas to solve.

Rise of the Smart Factory and Automation

It's not just the cars that are changing—it's how we build them. The "smart factory," or Industry 4.0, is becoming a reality on the ground, where AI, automation, and data work together to make manufacturing more efficient and resilient.

Robotic arms are handling complex assembly tasks with more precision than ever. AI systems now monitor machinery, predicting when a part might fail to prevent expensive downtime. This level of automation doesn't just improve quality and worker safety; it gives manufacturers the flexibility to adapt on the fly.

Disclaimer: ClimateRiskNow does not sell insurance or provide financial advice. The information provided is for educational purposes only, intended to help business leaders assess and prepare for operational risks without recommending specific financial products.

The Dawn of Autonomous Driving and Connectivity

The car of the future isn't just electric; it's also connected and, eventually, autonomous. Vehicles are quickly becoming powerful computers on wheels, communicating with each other and with infrastructure (Vehicle-to-Everything, or V2X).

This connectivity unlocks new services and safety features. Real-time traffic data, over-the-air software updates, and advanced driver-assistance systems (ADAS) are becoming standard. This constant data stream is also creating new business models. For example, some insurers use telematics to get a more accurate picture of risk.

While true, hands-off Level 5 autonomous driving is still a ways off, the steady improvements in ADAS are already making our roads safer and fundamentally changing the driving experience.

Here's a quick look at how these major forces are converging:

Major Trends Shaping the Future of Car Manufacturing

| Trend | Description | Impact on Operations |

|---|---|---|

| Electrification | The industry-wide shift from internal combustion engines to battery-electric powertrains. | Requires new supply chains for batteries, revamped factory layouts, and new worker skill sets. |

| Smart Factories (Industry 4.0) | Integrating AI, IoT, and robotics for data-driven, automated, and predictive manufacturing. | Increases efficiency, reduces downtime through predictive maintenance, and improves quality control. |

| Connectivity & Autonomy | Vehicles becoming software-defined platforms with advanced driver-assistance and V2X communication. | Shifts focus to software development, cybersecurity, and managing massive data streams. |

| Mobility-as-a-Service (MaaS) | A shift from personal car ownership to on-demand mobility services like ride-sharing and subscriptions. | Pushes automakers to become service providers, managing fleets and developing user platforms. |

These trends don't exist in a vacuum; they feed into each other, creating a complex but exciting future for the industry.

New Business Models Emerge

As the idea of owning a car changes, so do the business models. Mobility-as-a-Service (MaaS) is catching on, especially in cities. This approach bundles different types of transportation—ride-sharing, public transit, car rentals—into a single on-demand app.

This has huge implications for carmakers, who might have to shift from just selling cars to becoming full-blown mobility providers. For logistics companies, the promise of autonomous trucks could completely reshape how freight moves, offering huge efficiency gains but also bringing new operational headaches.

It's often useful to look at parallel industries. For instance, seeing the future of manufacturing trends in Australia within the heavy equipment sector provides a different lens on industrial evolution. All these connected shifts point to a future where success will be determined by flexibility, a willingness to adopt new technology, and smart, strategic foresight.

Frequently Asked Questions

When trying to get a handle on the car manufacturing industry, many questions arise. Here are direct answers to the big ones we hear from business leaders, cutting through the noise to give you a clear picture of the risks, tech shifts, and market outlook shaping the sector.

What Are The Biggest Risks Facing The Automotive Industry Today?

The industry is navigating a minefield of interconnected risks. For any Texas-based company, understanding these risks is the first step toward building resilience.

The most immediate challenge remains the supply chain. The semiconductor shortage was a major wake-up call, but weak spots exist everywhere. It doesn't take much—a localized freeze hitting a plastics supplier along the Gulf Coast, for instance—to cause problems that ripple all the way down the line.

On top of that, geopolitical tensions are another wrench in the works. Tariffs and trade barriers can inflate the cost of parts overnight and throw carefully planned logistics into chaos. A study on the potential effects of U.S. tariffs shows how directly these policies can hit home, raising costs for both manufacturers and car buyers.

Beyond these external pressures, the industry is grappling with its own battles:

- Economic Volatility: People buy new cars when they feel confident about the economy and interest rates are reasonable. A downturn can dry up sales in a hurry, leaving manufacturers with lots full of unsold vehicles.

- The EV Gamble: Shifting to electric vehicles costs a staggering amount of money. Automakers are pouring billions into an EV future, and if consumer adoption stalls, it becomes a massive financial risk.

- Regulatory and Climate Pressures: Tougher environmental rules demand constant, expensive innovation. At the same time, the real-world operational risks from extreme weather—like hurricanes on the Gulf Coast or a deep freeze in North Texas—are a direct threat to production plants and the routes that supply them.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. This information is purely for educational purposes, designed to help decision-makers in Texas industries understand and prepare for operational risks without pushing specific financial solutions.

How Is Technology Changing Car Manufacturing?

Technology isn't just tweaking things; it's fundamentally rewriting the rules of the factory floor and the cars themselves. That old buzzword, 'Industry 4.0,' isn't a concept anymore—it's a reality. We're talking about 'smart factories' where artificial intelligence (AI), the Internet of Things (IoT), and advanced robotics are all integrated.

This is about much more than just adding more robots to the assembly line. AI-powered systems can now predict when a machine is about to fail, letting you schedule repairs before it causes a costly shutdown. Automated systems are taking on repetitive, back-breaking tasks with incredible precision, which boosts build quality and makes the workplace safer.

This digital thread runs far beyond the factory. It’s making the entire supply chain more transparent, using advanced data analytics to provide a real-time view of inventory and shipments. This means smarter resource management and a far more resilient, data-driven manufacturing ecosystem.

What Is The Outlook For Combustion Engine Vehicles?

The long-term outlook for the internal combustion engine (ICE) is a managed decline. Simple as that. While the headlines are all about the EV revolution, gasoline-powered cars will still make up a big part of the market for at least another decade. This is especially true in places without great charging infrastructure or where consumers prefer a traditional engine, as is common in many parts of Texas.

To cover their bases, many manufacturers are investing heavily in hybrid technologies. For many consumers, hybrids are the perfect bridge. They offer better gas mileage and lower emissions without the "range anxiety" that can come with going fully electric.

But make no mistake, the forces pushing the industry away from ICE are strong and getting stronger. Tighter global emissions regulations and government mandates—some aiming to phase out gas car sales entirely—are setting a clear deadline. As a result, almost all the serious research and development money is now flowing into EV and battery technology. The millions of gasoline cars already on the road mean they won't disappear overnight, but their role is shifting from the industry's present to its past.

To effectively manage the operational risks highlighted in this analysis, Texas business leaders need precise, location-specific intelligence. ClimateRiskNow delivers actionable weather risk assessments that quantify your facilities' exposure to hurricanes, flooding, freezes, and more. Transform complex climate data into a strategic advantage and safeguard your operations.