Reinsurance is, in effect, insurance for insurance companies. It is a foundational financial mechanism that allows a primary insurer to transfer portions of its risk portfolio to another, often larger, financial entity. This strategic risk distribution ensures the primary insurer can honor its policyholder obligations, even after a catastrophic event generates massive claims, thus preventing its own insolvency.

Reinsurance: The Insurer's Financial Backstop

For business leaders in Texas, an insurance company can be compared to a general contractor on a large-scale industrial construction project. The contractor holds ultimate responsibility for project completion but prudently subcontracts specialized, high-risk tasks like foundational engineering or complex electrical systems. This distribution of risk is a core principle of sound project management, ensuring project continuity even if one component encounters significant challenges.

This is analogous to how an insurer utilizes reinsurance. The insurer "cedes"—or transfers—portions of its most concentrated risks to one or more reinsurance companies. A relevant Texas example is the aggregated risk exposure from a single hurricane impacting hundreds of commercial properties along the Gulf Coast. This behind-the-scenes financial transaction is fundamental to the stability of the global insurance market.

Why This Matters for Your Texas Business

Understanding what reinsurance is in insurance is critical for any Texas executive tasked with operational risk management. This mechanism provides insurers with the financial capacity and confidence required to underwrite the large-scale, complex risks inherent in the state’s key industries, such as Energy, Manufacturing, and Logistics.

Without a robust reinsurance market, securing adequate coverage for high-value assets like offshore energy platforms, large manufacturing facilities, or extensive logistics fleets would be significantly more challenging and cost-prohibitive. The stability reinsurance provides directly impacts business operations:

- Coverage Availability: It enables insurers to offer policies for high-risk operations and geographic locations they might otherwise avoid.

- Market Stability: It prevents the collapse of a regional insurance market following a widespread disaster by distributing financial losses across a global capital base.

- Claim Payouts: It ensures an insurer maintains the necessary liquidity to pay large claims promptly after an extreme weather event, facilitating faster recovery for affected businesses.

The global risk-sharing system is expanding, driven largely by the increasing frequency and severity of natural disasters. The global reinsurance market was valued at approximately $581.3 billion and is projected to reach $1.17 trillion by 2033. This growth underscores the critical role of reinsurance in protecting regional economies from catastrophic financial shocks.

To clarify the structure, the following table outlines the key participants and terminology in a standard reinsurance agreement.

Key Reinsurance Players and Concepts

| Term | Role in the Reinsurance Process | Example for a Texas Business |

|---|---|---|

| Ceding Company | Your primary insurance provider who is transferring, or "ceding," a portion of their risk. | The insurer underwriting the policy for your coastal manufacturing facility. |

| Reinsurer | A large, often global, financial institution that accepts the ceded risk in exchange for a premium. | A company like Swiss Re or Munich Re that agrees to cover a share of potential hurricane damage losses for the primary insurer. |

| Cession | The specific portion of risk that is transferred from the ceding company to the reinsurer. | The primary insurer cedes 50% of the risk on all commercial property policies it holds in counties along the Texas Gulf Coast. |

| Premium | The payment the ceding company makes to the reinsurer for assuming the specified risk. | Your insurer pays the reinsurer a portion of the premiums collected from your company and other policyholders. |

This tiered financial structure creates a resilient chain of risk distribution that protects all parties, from the global reinsurer down to your local business operations.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided in this article is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation. Our goal is to empower Texas business leaders with data-driven insights for risk management.

Reinsurance is the silent, powerful partner in your company’s operational risk management framework. It is the financial foundation that enables your insurer to honor its contractual promise to pay, even after a disaster on the scale of Hurricane Harvey. For a deeper analysis of this topic, refer to our comprehensive guide on navigating insurance for natural disasters.

Why Reinsurance Is Crucial for Texas Industries

For decision-makers in Texas, reinsurance is not an abstract financial instrument. It is the core mechanism that allows primary insurers to underwrite the substantial, concentrated risks characteristic of the state's most critical sectors—from Energy and Petrochemical to Manufacturing, Logistics, and Agriculture. Without this global financial safety net, obtaining the necessary operational coverage would be more difficult and significantly more expensive.

A healthy reinsurance market fosters a stable primary insurance market. It provides insurers with the capacity to absorb the massive financial impact of a catastrophic event without facing insolvency. This ensures they can continue to offer policies and, most importantly, pay claims when businesses need it most. It prevents a market-wide failure where coverage becomes unavailable or unaffordable following a major disaster.

Stabilizing the Market After Catastrophic Events

Consider the aftermath of a major hurricane striking the Gulf Coast. Total insured losses can quickly escalate into the tens of billions. No single insurance company has the capital reserves to absorb such a financial shock alone. Reinsurance functions by spreading these enormous losses across a global network of reinsurers, with each entity assuming a manageable portion of the total financial damage.

This distribution of risk is what mitigates extreme premium volatility following a disaster. For example, after Hurricane Harvey caused an estimated $125 billion in total economic damages, the global reinsurance market absorbed a significant portion of the insured losses. This financial backstop was instrumental in stabilizing the Texas insurance market and preventing the kind of crippling rate increases that would have otherwise followed such a devastating event.

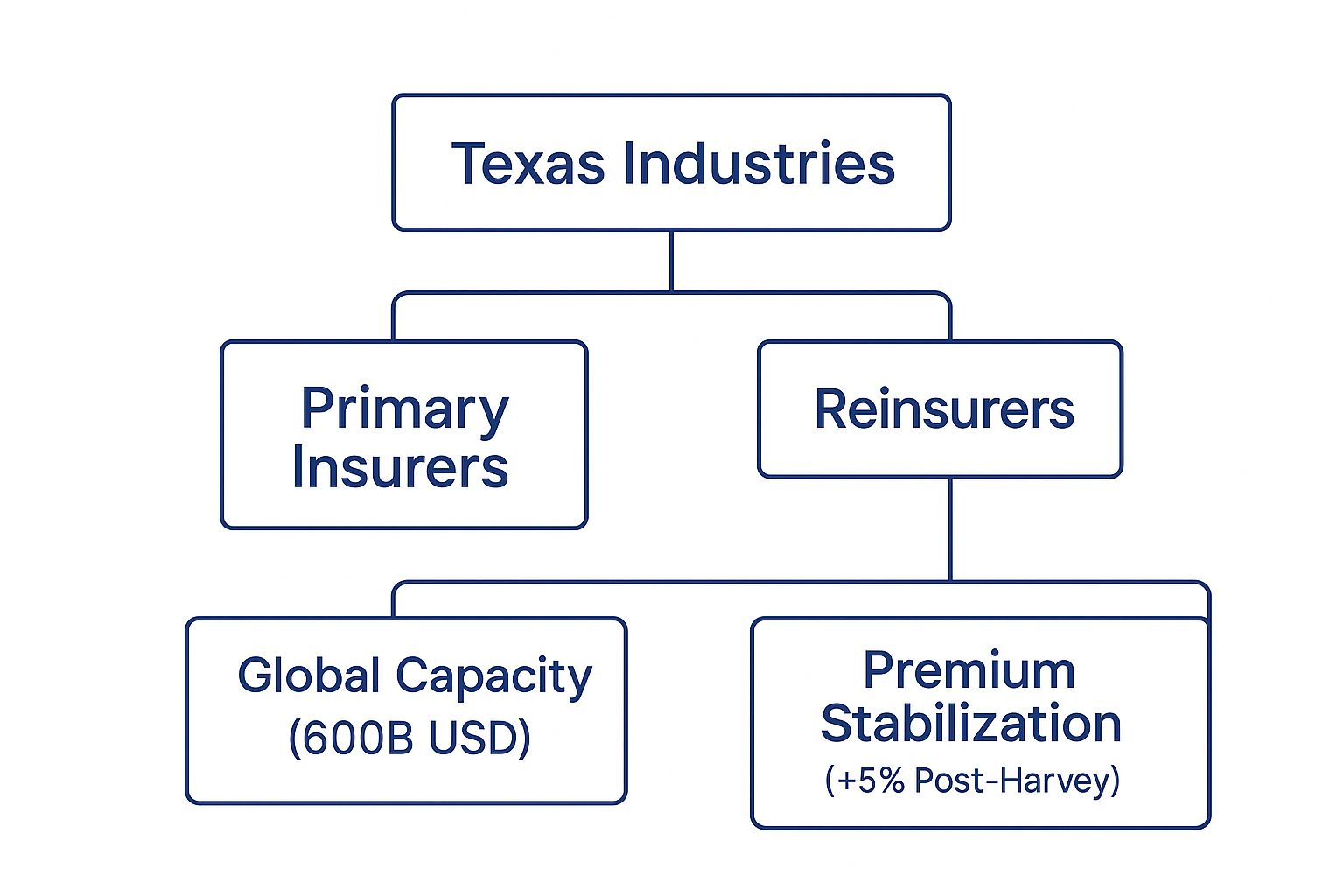

The infographic below illustrates how reinsurers create a deep pool of capital that supports primary insurers, which in turn benefits Texas industries.

This structure allows hundreds of billions in global reinsurance capacity to moderate premium fluctuations and ensure financial resilience after major localized disasters.

Enabling Coverage for Complex and Emerging Risks

Reinsurance also provides primary insurers with the financial confidence needed to cover new and evolving threats—risks that are increasingly critical to Texas operations. As climate patterns shift, businesses face heightened exposure to events like severe freezes that disrupt the power grid, prolonged droughts impacting the agriculture sector, and intense storms causing widespread supply chain disruptions.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation. Our mission is to provide data-driven insights to help business leaders manage operational risks.

By transferring a portion of these high-severity risks, primary insurance carriers can expand their underwriting appetite. This means they are more willing to offer policies for unique, high-value assets and complex operational exposures that might otherwise be deemed uninsurable. Whether for a new petrochemical facility, a large-scale logistics hub, or a major construction project, reinsurance provides the financial capacity to make coverage viable.

This capacity is essential for managing the diverse environmental exposures across Texas. To better understand these varied threats, you can explore our overview of different natural risk examples impacting Texas industries. The practical outcomes for your business are clear: consistent availability of essential coverage, more predictable market conditions, and confidence that your insurer can assume the significant, industry-specific risks you face.

How Reinsurance Agreements Are Structured

Reinsurance agreements are not monolithic; they are precisely engineered financial contracts that an insurer uses to manage specific types of risk exposures. These agreements can be structured to cover a broad portfolio of policies or a single, high-value asset. For Texas business leaders, understanding these structures provides insight into the rationale behind insurance pricing and availability, particularly for operations exposed to significant weather threats.

The two principal structures for these agreements are Treaty and Facultative reinsurance.

Treaty Reinsurance: The Blanket Agreement

Treaty reinsurance functions like a long-term master service agreement. The reinsurer agrees in advance to automatically assume a predetermined share of all risks within a specific, defined class of business that the primary insurer underwrites. It is an ongoing, automated relationship that covers an entire portfolio, or "book," of business.

For example, an insurer covering hundreds of commercial properties along the Texas Gulf Coast may have a property catastrophe treaty. This agreement allows the insurer to automatically "cede" a portion of every one of those policies to a reinsurer. This structure efficiently transfers a predictable slice of their aggregate hurricane risk, providing the insurer with the balance sheet stability needed to continue writing new policies. The primary benefit is operational efficiency, as the insurer does not need to negotiate a separate reinsurance deal for each policy it sells.

Facultative Reinsurance: The One-Off Specialist

In contrast, Facultative reinsurance is analogous to engaging a specialist consultant for a unique, high-stakes project. This type of reinsurance is negotiated on a case-by-case basis for a single risk that is too large, complex, or unusual to be covered under a standard treaty agreement.

A pertinent Texas example is the insurance placement for a new, multi-billion-dollar LNG export terminal. The risk profile of such an asset is immense and does not fit a standard underwriting category. The primary insurer would approach multiple reinsurers to place the risk, with each reinsurer agreeing to cover a specific portion until the facility's total value is insured.

This project-based approach allows insurers to secure the massive capacity needed to cover one-of-a-kind industrial assets. It is the mechanism that makes it possible to insure critical infrastructure projects that are vital to the Texas economy but carry extraordinary risk.

The decision of which structure to use is based on extensive data analysis. Insurers use sophisticated modeling to determine the optimal method for protecting their balance sheets, a process you can learn more about by exploring the use of advanced analytics for insurers.

Comparing Treaty and Facultative Reinsurance

For Texas business leaders, a side-by-side comparison clarifies why insurance for a small warehouse is managed differently from that of a massive industrial complex.

| Feature | Treaty Reinsurance | Facultative Reinsurance |

|---|---|---|

| Scope | Covers a broad portfolio or "book" of similar policies (e.g., all commercial property in a region). | Covers a single, specific risk (e.g., one petrochemical plant or major bridge). |

| Agreement | Ongoing, automatic acceptance of risks that fit the pre-agreed criteria. | Negotiated individually for each risk on a case-by-case basis. |

| Best For | Managing a large volume of predictable, similar risks efficiently. | Insuring unique, high-value, or unusually hazardous assets. |

| Analogy | A long-term master service contract with a supplier. | Hiring a specialized consultant for a single, complex project. |

| Example | A reinsurer agrees to assume 20% of an insurer's entire commercial property portfolio in Harris County. | A reinsurer is asked to cover $50 million of a $500 million LNG facility. |

This table highlights the core difference: treaty reinsurance is about managing portfolio risk, while facultative reinsurance is about addressing a single, significant risk exposure.

Proportional vs. Non-Proportional Structures

After deciding between a treaty or facultative approach, the insurer and reinsurer must determine how to share the premiums and losses. This is governed by two primary models.

- Proportional (Pro Rata): In this straightforward arrangement, the reinsurer assumes a fixed percentage of the risk and receives the same percentage of the premium. If a reinsurer takes on 30% of the risk, it receives 30% of the premium and is responsible for 30% of any claims.

- Non-Proportional (Excess of Loss): This structure functions like a high-deductible insurance policy for the insurance company. The primary insurer retains all losses up to a specified amount—for instance, the first $10 million from any single event. The reinsurer is only obligated to pay for losses that exceed that $10 million retention, up to a pre-agreed limit (e.g., up to $100 million).

This "excess of loss" model is the predominant structure for catastrophe reinsurance. It protects the primary insurer from a single, large-scale event that could threaten its solvency, while allowing it to manage smaller, more routine claims internally.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

The Role of Global Capital in Protecting Texas Operations

To fully grasp what reinsurance is, one must follow the flow of capital. Reinsurance is not merely a contractual agreement; it is a massive, global system designed to absorb financial losses that would otherwise cripple even the largest insurance carriers.

This system acts as a worldwide financial reservoir, enabling the market to manage a localized Texas catastrophe, such as a hurricane impacting the Houston Ship Channel, without collapsing. When an insurer pays a claim for operational downtime at a manufacturing plant or damage to a construction site, it often relies on this global network of funds. The scale of this capital is what gives an insurance policy its financial integrity. It is the guarantee that funds will be available to pay claims following a major event, providing the financial backbone for a company’s entire risk management strategy.

The Scale of the Global Safety Net

The amount of capital dedicated to reinsurance illustrates the industry’s capacity to handle major disasters. This is a global financial powerhouse, not a niche market.

The total pool of funds available to underwrite risk—known as global dedicated reinsurance capital—has reached an unprecedented $805 billion. This figure demonstrates a strong recovery from recent market volatility and proves the resilience of the system backing your primary insurer. For perspective, in 2012, traditional reinsurance capital stood at just $292 billion, with alternative capital at a mere $38 billion. Today, traditional capital has climbed to $535 billion, while alternative capital has surged to $114 billion.

This deep well of capital means that when a catastrophic weather event hits Texas, the financial impact is distributed among investors and institutions worldwide. The burden does not fall solely on the local insurance market.

Alternative Capital and Innovation

A significant portion of this growth comes from innovative financial instruments, often termed alternative capital. These are not traditional reinsurance companies but rather investment vehicles like catastrophe bonds and other insurance-linked securities (ILS).

These instruments allow institutional investors—such as pension funds and large asset managers—to invest directly in insurance risk. They are effectively taking a position on the probability of a specific, catastrophic event not occurring. If the event does not happen, they earn a return on their investment. If it does, their capital is used to help pay the resulting claims.

This influx of new capital has dramatically expanded the total capacity of the reinsurance market, fostering greater competition. For businesses in Texas, this translates into tangible benefits:

- Increased Capacity: More capital is available to cover the state's largest and most complex risks, from sprawling petrochemical plants to vital logistics hubs.

- Market Resilience: A more diverse capital base makes the reinsurance market less fragile, helping to stabilize pricing and ensure coverage availability over the long term.

Understanding this financial structure is key to appreciating how large-scale risks are managed. To apply these concepts to your own operations, a detailed risk analysis is the necessary starting point.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

How a Reinsurance Claim Protects Your Business

To understand the practical application of reinsurance, let's trace a claim from a major Texas hurricane through its resolution in the global market. This case study demonstrates how this worldwide financial network facilitates business recovery.

Consider a large manufacturing plant in Houston impacted by a major hurricane. The storm's high winds damage the roof, and subsequent flooding ruins millions of dollars in critical machinery and inventory, leading to a complete operational shutdown. Each day of downtime represents a significant financial loss.

The Claim Starts Locally

First, your company’s risk management team assesses the damage and files a major claim with your primary insurance provider. The claim covers property damage, equipment replacement, and business interruption losses, totaling an estimated $50 million.

From your company's perspective, the process is direct. The insurer’s adjusters verify the damage and process the payment. The funds are disbursed, allowing you to begin repairs, order new equipment, and cover the costs associated with the shutdown. You filed a claim, and your insurer paid it.

Behind the scenes, however, a separate financial transaction is initiated. Your insurer must now manage that massive $50 million payout, likely alongside hundreds of other large claims from the same hurricane.

This is where reinsurance becomes critical. The insurer's ability to pay your claim promptly—without jeopardizing its own financial stability—is a direct result of its reinsurance agreements. It does not have to bear this loss alone.

The Reinsurer Steps In

Your primary insurer holds a catastrophe reinsurance treaty structured as an "excess of loss" agreement, designed specifically for such large-scale events. Here is a simplified breakdown of the capital flow:

The Insurer's Retention: The treaty stipulates that your insurer is responsible for the first $10 million of losses from a single catastrophe. This is its "retention," analogous to a deductible, which it pays from its own capital reserves.

The Reinsurer's Layer: For the remaining $40 million of your claim, the insurer turns to its reinsurance partners. These global firms are now contractually obligated to reimburse the insurer for all losses exceeding that $10 million retention level.

This transaction is invisible to your company but is the critical step that maintains systemic stability. The reinsurers remit $40 million back to your primary insurer, replenishing the capital it used to pay your claim.

This process demonstrates how a disaster in Texas is ultimately managed by a vast, global financial network. The capital required to rebuild your Houston facility flows from reinsurers around the world to your primary insurer, and finally to your business. This ensures the insurer has the liquidity to pay your claim without delay, safeguarding both your business and the stability of the entire Texas insurance market.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

How to Judge a Reinsurer's Financial Strength

A reinsurer's contractual promise to pay a claim is only as credible as its financial solvency. For business leaders in Texas, assessing this financial foundation is a critical consideration, as the stability of your own insurance carrier is directly linked to the financial health of its reinsurance partners. If a reinsurer fails following a catastrophe, the ability of primary insurers to pay claims could be impaired. This assessment is based on objective financial metrics that provide a clear indication of a reinsurer's profitability and resilience.

Key Metrics to Watch

Two of the most indicative metrics are the combined ratio and return on equity (ROE). Together, they offer a powerful snapshot of a reinsurer's underwriting discipline and financial health.

- Combined Ratio: This metric measures underwriting profitability. It is calculated by adding incurred losses and expenses and dividing the sum by the earned premium. A ratio below 100% indicates an underwriting profit, while a ratio over 100% signifies a loss.

- Return on Equity (ROE): This metric measures a company's profitability in relation to the equity held by its shareholders. A consistently strong ROE is a sign of a stable, well-managed firm capable of surviving market downturns and growing its capital base over the long term.

These metrics offer a clear view of market performance. For example, global reinsurers recently reported a combined ratio of approximately 87.5%. While this represents a slight increase from the prior year, it remains well below the 100% breakeven threshold, signaling continued underwriting profitability for the sector. The industry also posted a robust 17.7% return on equity, demonstrating its strong financial health.

The Role of Credit Rating Agencies

Independent credit rating agencies such as A.M. Best, S&P Global, and Moody’s provide third-party validation of a reinsurer's financial stability. These firms conduct in-depth analyses of a reinsurer's balance sheet, business strategy, and enterprise risk management practices.

These agencies issue financial strength ratings (FSRs), which serve as a standardized assessment of a reinsurer's ability to meet its policyholder obligations. A high rating—such as 'A' or better—provides stakeholders with confidence that the reinsurer possesses the capital and operational discipline to withstand major disasters.

A foundational step in this analysis is knowing how to interpret financial statements, which offers a clearer picture of a company’s financial position. A primary insurer that partners with highly-rated, financially sound reinsurers is better positioned to protect its own balance sheet. That strength is then passed down to you, the policyholder, in the form of reliable coverage and prompt claim payments.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

Your Burning Questions About Reinsurance

For Texas business leaders, the concept of reinsurance can appear abstract. However, its practical impact on your company's risk management strategy is very real.

How Does Reinsurance Actually Affect Our Insurance Premiums?

Reinsurance should be viewed as a component of an insurer's cost of goods sold. When reinsurers assess a higher probability of catastrophic events—such as another Texas freeze or a major hurricane—they increase the price of their coverage. Primary insurers, in turn, pass these higher costs on to their customers in the form of increased commercial insurance premiums. Conversely, a stable and competitive global reinsurance market can help moderate premium increases, even following a year of significant insured losses. The price your business pays is directly linked to the global market's appetite for Texas-specific risks.

Will We Ever Have to Deal Directly With a Reinsurer?

No, your contractual relationship is exclusively with your primary insurance company. Reinsurance is a business-to-business agreement between your insurer and its reinsurer. The terms of that agreement, however, can influence the coverage limits, conditions, and pricing of your policy. When you file a claim, your insurer pays you and then seeks recovery from its reinsurer. The entire process is designed to be seamless and invisible to the policyholder.

Why Do Huge Insurance Companies Still Need Reinsurance?

Even the largest global insurers rely on reinsurance to manage risk concentration and protect their capital base. A single catastrophic event, such as a hurricane striking a dense industrial corridor like the Gulf Coast, could generate claims substantial enough to threaten the financial solvency of any single company.

Reinsurance serves to place a ceiling on an insurer's maximum loss from any one disaster. This strategy is fundamental to maintaining financial stability, ensuring all claims can be paid, and preserving the capacity to underwrite new policies. It is an essential tool for capital protection and is critical for maintaining a stable insurance market for Texas businesses.

At ClimateRiskNow, we provide Texas business leaders with location-specific weather intelligence to build operational resilience against extreme weather. Our assessments deliver actionable, data-driven insights to help protect your assets, prepare for disruption, and mitigate financial risk.

Turn complex climate data into a strategic advantage. Request your assessment today.