As a freight forwarder, you are the architect of complex global supply chains. This central role comes with a world of operational, professional, and liability risks. Specialized insurance for freight forwarders is not just another business policy; it is a tailored financial shield designed for the unique challenges that are part of your daily reality.

Understanding these coverages is a key component of a robust risk management framework. It helps protect your business from financial losses stemming from events ranging from simple documentation errors to catastrophic cargo loss. Think of it as a critical asset that helps maintain financial stability and, just as importantly, your clients’ trust. This guide provides an educational overview to help Texas business leaders assess their risk landscape.

Assessing Risk in Modern Freight Forwarding

Operating a freight forwarding business in the high-stakes world of global logistics requires advanced planning. For business leaders in Texas-based industries like Energy, Manufacturing, and Agriculture, a comprehensive risk management strategy is essential for navigating the volatile waters of global trade and the increasing frequency of extreme weather events.

Standard business policies often contain exclusions that can leave significant gaps where your business faces the most exposure. A well-structured insurance program is a strategic tool that builds resilience, safeguards client relationships, and shores up your finances in an industry defined by uncertainty.

The Evolving Risk Landscape

Today's supply chains are more complex than ever, and that complexity multiplies your risk. With countless handoffs between different transport modes and stakeholders, the potential for an operational failure—and for your firm to be held liable—has increased.

Market data underscores this trend. The logistics insurance market, which includes freight forwarder liability, accounted for over 36% of the global insurance market revenue in 2022, representing approximately USD 56.4 billion. This market is projected to grow as more businesses recognize these intricate risks.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

Core Coverages for Comprehensive Risk Mitigation

A sound risk management strategy is not built on a single policy. It requires several key coverages working in concert, each one addressing a different component of your operational and professional liability profile.

The following are foundational coverages:

- Errors & Omissions (E&O): This provides coverage against claims of professional negligence. Examples include incorrect customs filings, missed deadlines, or logistical errors that result in a financial loss for your client.

- Cargo Liability: This policy addresses your legal responsibility for physical loss or damage to the goods you are managing.

- General Liability: This covers third-party bodily injury or property damage that occurs on your premises, such as a "slip and fall" incident.

These policies form the basis of a risk mitigation plan for any Texas logistics business. Their importance is amplified when considering disruptions from extreme weather. For instance, understanding how to prepare for hurricane season is not just about protecting physical assets; it is a crucial part of managing your liability risks along the Gulf Coast.

Understanding Freight Forwarder Liability Insurance

While cargo coverage is designed to protect physical goods, another critical layer of insurance shields your freight forwarding business from professional missteps. This is Freight Forwarder Liability insurance, commonly known in the industry as Errors & Omissions (E&O).

This coverage is not for lost pallets or damaged containers. E&O is professional liability coverage for the services you provide.

Consider a clerical mistake—a misclassified Harmonized System (HS) code on a customs declaration for a large shipment arriving at the Port of Houston. That single error can escalate, potentially triggering customs fines, significant shipment delays, and a damaged client relationship. E&O insurance is structured specifically for these types of professional risks.

Distinguishing Service Risk from Cargo Risk

For any Texas business leader in logistics, manufacturing, or energy, understanding this distinction is a fundamental step toward a robust risk management strategy. It involves separating the risk associated with your actions from the risk to the cargo itself.

E&O insurance is designed to respond to claims arising from:

- Negligence: A failure to exercise a reasonable standard of care in performing your professional duties.

- Documentation Mistakes: An incorrect number on a bill of lading, improper customs paperwork, or flawed shipping instructions.

- Failure to Follow Instructions: Not adhering to a client's specific routing or handling requirements, resulting in a financial loss for them.

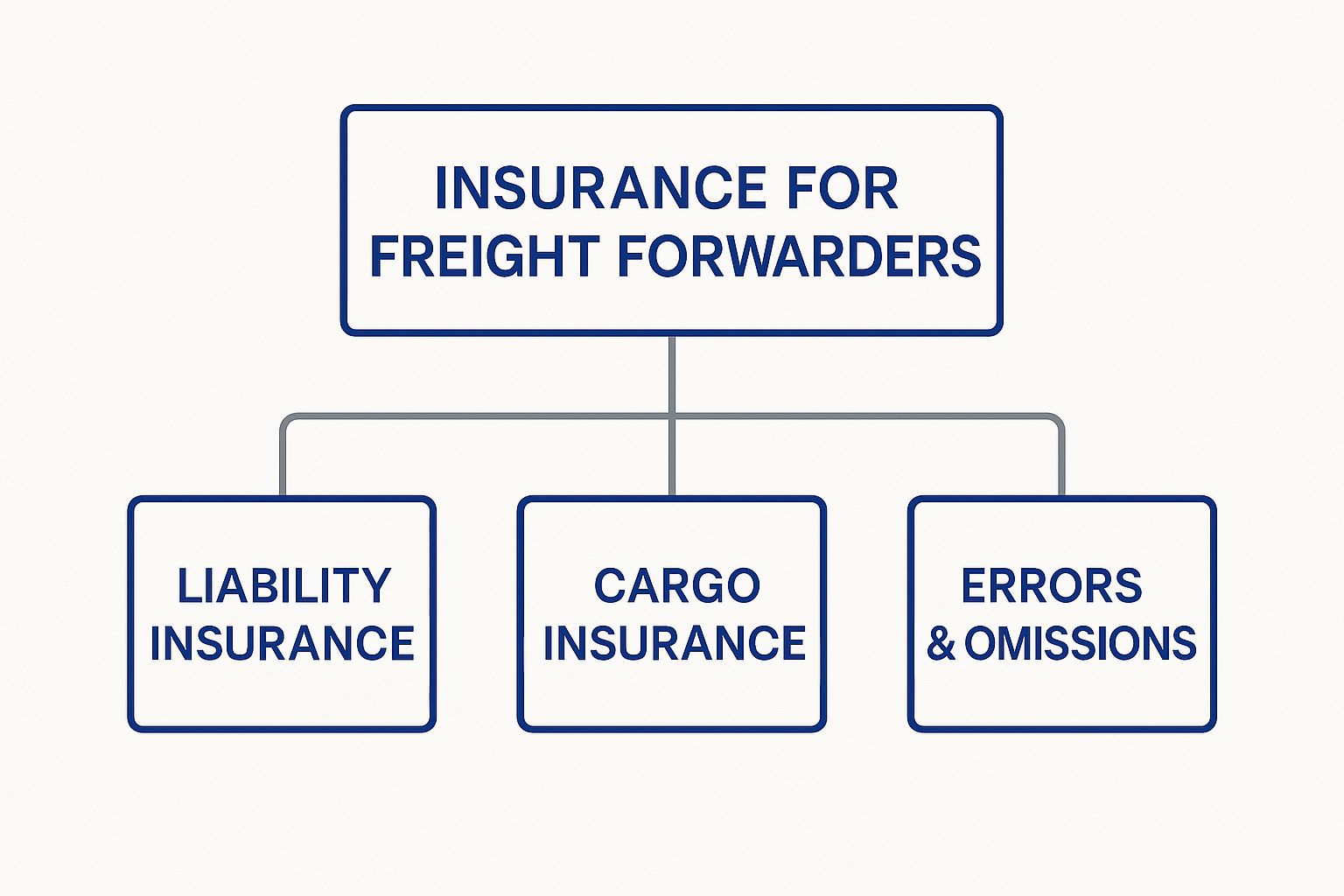

This visual helps clarify where E&O fits within a broader risk management framework.

The diagram illustrates that liability for your services is a distinct exposure from the insurance covering the physical goods. They are separate but complementary.

To further clarify, here is a breakdown of how these policies differ in practice.

Key Freight Forwarder Insurance Policy Comparison

This table contrasts the primary functions and coverage areas of three critical insurance policies for a freight forwarding business, helping to clarify their distinct roles.

| Policy Type | Primary Purpose | Example Coverage Scenario |

|---|---|---|

| Cargo Insurance | Protects the physical goods against loss or damage during transit. | A container of petrochemical products is contaminated by water during an ocean voyage. |

| Errors & Omissions (E&O) | Covers financial losses a client suffers due to your professional mistakes or negligence. | You book a shipment on the wrong vessel, causing a manufacturing plant to halt production and lose revenue. |

| General Liability | Protects against third-party claims of bodily injury or property damage on your premises. | A delivery driver slips and is injured in your warehouse. |

As shown, each policy has a specific function. Relying on one to cover all exposures is a common but flawed approach to risk management.

Real-World Scenarios and Coverage Gaps

Let's consider a practical example. A forwarder arranges a time-sensitive shipment of components for a major Texas manufacturing plant. A booking error is made, and the shipment misses its vessel. The plant's production line halts, costing the client hundreds of thousands in lost revenue. The manufacturer may then file a claim against the forwarder alleging professional negligence.

This is a scenario where E&O insurance is designed to respond. A general liability policy would not typically cover this, as it wasn't a physical accident. Cargo insurance is also not applicable because the goods were not lost or damaged, but were delayed due to a service failure.

It is crucial to understand that E&O insurance does not cover the physical loss of or damage to cargo. That exposure requires a separate cargo policy. Relying on one policy to cover all risks leaves a business dangerously exposed.

This layered approach is a best practice for operational continuity. The most effective emergency management frameworks operate on the same principle: identify specific risks and align dedicated resources to mitigate each one. Building a resilient insurance program works the same way.

Without a distinct policy for professional errors, a single mistake could jeopardize your company's financial stability. For any decision-maker in the Texas logistics or manufacturing sectors, recognizing this potential gap is an essential part of strategic risk management.

The Freight Forwarder’s Role in Cargo Insurance

As a freight forwarder, your role in cargo insurance is twofold: you act as a knowledgeable resource for your clients while also protecting your own company's financial health. Effectively managing this dual responsibility is a non-negotiable aspect of risk management.

The market for this protection is substantial and growing. In 2025, the global cargo insurance market is valued at approximately USD 75.2 billion and is projected to grow at a compound annual rate of about 4.5% through 2033. This growth is driven by increasing global trade volumes and a heightened awareness of transit-related risks, from damage and theft to catastrophic losses due to extreme weather. You can find more data on the cargo insurance market's growth factors here.

For your clients, the primary options are typically All-Risk and Named Perils policies. The distinction is straightforward.

All-Risk vs. Named Perils Coverage

An All-Risk policy provides broad coverage for cargo. It protects against most causes of loss, unless a specific event (such as war or inherent vice) is explicitly excluded in the policy language. It is generally the broadest form of protection available.

In contrast, a Named Perils policy is more restrictive. It only covers losses from a specific list of events, such as a fire, vessel collision, or theft. If the cause of the loss is not on that list, there is no coverage.

Clearly explaining these options is essential, especially for your clients in Texas's manufacturing, energy, and agriculture sectors. This information empowers them to make an informed decision to protect the full value of their goods in transit.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

Your Business’s Financial Safety Net

Beyond advising clients, your own business requires protection. This is the role of Contingent Cargo Liability insurance. This policy serves as a financial backstop.

It is designed to respond when other policies fail. For example, it can provide a critical layer of defense if:

- A client's primary cargo policy does not pay out due to a policy violation or insurer insolvency.

- The client's coverage limit is insufficient to cover the full value of the lost or damaged goods.

- A carrier’s liability coverage is denied or exhausted, and you are held responsible for the financial loss.

Without this contingent coverage, your company could be liable for the full financial impact of a major cargo claim. Part of your role involves managing expectations by explaining the statutory limits of carrier liability under regulations like the Carmack Amendment or COGSA and highlighting the importance of shipper's interest cargo insurance.

This transparency not only helps close liability gaps but also builds trust with your clients and protects your bottom line from unexpected disruptions, including those detailed in our guide on building supply chain resilience against extreme weather.

Covering Your Daily Operational Risks

In addition to the specific risks of global transport, your freight forwarding business faces the same day-to-day exposures as any other company with a physical presence. These are the operational but equally critical risks that policies like Commercial General Liability (CGL) and Commercial Auto Liability are designed to address. For any business decision-maker in Texas, securing these foundational coverages is the first step in building a solid defensive strategy.

Commercial General Liability (CGL) acts as a protective layer for your physical property and operations. Its function is to respond when a third party sustains an injury or property damage at your warehouse or office in a context unrelated to cargo handling.

For example, if a client visiting your facility is injured in a slip-and-fall accident, your CGL policy is designed to cover the associated medical costs and potential legal expenses. It addresses the tangible, on-site risks inherent in running a business.

Protecting Your Fleet and Your Business

Similarly, Commercial Auto Liability is essential for any vehicles your company owns. This applies to every company vehicle, from a small van making deliveries in Houston to the sedans your sales team uses to visit clients in the construction and energy sectors across Texas.

If a company vehicle is involved in an accident that causes injury to another person or damages their property, this is the policy designed to respond. Given the extensive road networks connecting Texas’s industrial hubs, this coverage is a fundamental component of risk management.

Important Distinction: It is crucial for decision-makers to understand that CGL and Commercial Auto are not substitutes for specialized freight forwarding insurance like E&O or Contingent Cargo. They function together, creating layers of defense against a wide spectrum of business risks.

Creating a Comprehensive Risk Management Framework

These two policies form the foundation of your insurance portfolio. They address liabilities that exist regardless of shipment volume—the risks that arise from employees, customers, and vendors physically interacting with your business and its assets.

A well-structured insurance program ensures there are no gaps between your general operational liabilities and your specific duties as a freight forwarder. To see how these elements fit into a broader strategy, you can explore our detailed guide on what is operational risk management.

Ultimately, integrating these foundational coverages with your specialized policies creates a much stronger safety net. This approach allows Texas freight forwarders to confidently manage both the unique complexities of global logistics and the universal risks of running a successful enterprise.

How to Assess Your Risk in a Volatile Market

Understanding insurance policies is one part of the equation; applying that knowledge to today’s turbulent global market is another. Geopolitical instability, persistent port congestion, and evolving regulations amplify the risks your Texas-based business must navigate daily.

These macroeconomic trends have direct consequences for your insurance needs and overall risk profile.

For example, widespread supply chain disruptions can increase the likelihood of Errors & Omissions claims. Unavoidable delays and last-minute rerouting are now common operational challenges. Simultaneously, when cargo remains at congested ports for extended periods, the risk of theft and damage increases, placing greater strain on cargo liability coverage.

Conducting a Practical Risk Assessment

A thorough risk assessment is a strategic imperative that aligns your insurance coverage with the actual threats your business faces. This process involves a methodical review of your operations to identify specific vulnerabilities that could lead to a financial loss.

The goal is to move beyond generalities and pinpoint concrete risks to ensure you have the right insurance for your specific operational challenges.

Begin by analyzing these key areas:

- Trade Lane Analysis: Evaluate the stability of the regions where you operate. Are there escalating political risks, new tariffs, or unforeseen regulatory hurdles along your key routes? What are the local weather-related risks, such as hurricane exposure at Gulf Coast ports?

- Commodity Review: What types of goods are you transporting? High-value electronics, perishable agricultural products, and hazardous petrochemicals each have unique risk profiles that require specific consideration.

- Contractual Obligations: Review your agreements with clients and carriers. What liability have you contractually assumed? Ensure your insurance policies are structured to support those commitments.

Aligning Coverage with Market Realities

The global freight forwarding industry is complex and volatile. Projections for 2025 indicate a potential market contraction of about 1.1%, driven largely by geopolitical friction and ongoing logistical challenges in critical maritime corridors. This environment makes risk mitigation more complex, compelling forwarders to closely examine their insurance to protect against costly delays and legal claims.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

This market volatility is compounded by physical risks. Extreme weather events can paralyze ports and halt transit. A hurricane in the Gulf of Mexico or an ice storm in North Texas can instantly transform a routine shipment into a major liability event.

Analyzing your exposure to these threats is a critical part of a modern risk assessment. To better understand these exposures, review our guide on various natural risk examples for businesses. By connecting the dots between your day-to-day operational realities and your insurance portfolio, you can make more informed decisions to protect your business, your clients, and your bottom line.

We Get These Questions All The Time

If you are working to understand insurance for freight forwarding, you are not alone. We often hear the same questions from Texas business leaders seeking to navigate these complexities. Clarifying a few common points of confusion can help you build a more effective risk management strategy.

What's the Real Difference Between Policies?

One of the primary challenges is understanding that you are covering two distinct types of risk: your professional services and the physical cargo. They are separate exposures and require separate solutions.

So, what's the main difference between freight forwarder liability and cargo insurance?

Simply put, Freight Forwarder Liability, also known as Errors & Omissions (E&O), is professional liability coverage. It protects your business from the financial consequences of your own mistakes—such as documentation errors, improper carrier selection, or other acts of negligence that result in a financial loss for your client.

On the other hand, cargo insurance pertains to the goods themselves. It covers the physical loss or damage to the freight during transit. Both are essential; one covers your actions, the other covers the cargo.

When a Carrier Fails, Who is Responsible?

Using third-party carriers can sometimes blur the lines of responsibility. It is critical to know where your liability begins and ends, especially when a shipment is lost or damaged while in their care.

Is my business covered if a carrier I hire loses the cargo?

Not automatically. Your E&O policy might respond if you were negligent in how you vetted or selected that carrier. However, this is precisely why contingent cargo insurance is so critical.

This specific policy acts as your financial backstop. It is designed to protect your business if the carrier's own insurance policy is exhausted, a claim is denied, or they fail to pay.

Disclaimer: ClimateRiskNow does not sell insurance or financial products. The information provided is for educational purposes only and should not be interpreted as financial advice or an insurance recommendation.

Why Your Basic Business Policy Isn't Enough

Many business owners assume a standard general liability policy is a comprehensive safety net. For a freight forwarder, this is a dangerous assumption, as the unique risks in logistics are often not covered by it.

Why isn't a standard general liability policy enough for a freight forwarder?

A standard Commercial General Liability (CGL) policy is designed for events like bodily injury or property damage that occur on your premises—the classic "slip-and-fall" scenario.

Crucially, CGL policies almost always contain specific exclusions for the professional services you provide and for the cargo under your care, custody, and control. Relying solely on a CGL policy leaves significant gaps in your coverage. Each insurance policy plays a distinct role, and one cannot be expected to do the job of another.

At ClimateRiskNow, we provide Texas-based businesses in the Energy, Logistics, and Manufacturing sectors with actionable, location-specific weather risk intelligence. Our Sentinel Shield assessments empower you to safeguard assets, optimize resilience, and ensure operational continuity against threats like hurricanes, floods, and freezes. Transform complex climate data into a strategic advantage and protect your operations. Request a demo of Sentinel Shield today.